TL;DR

JointFM is the primary AI basis mannequin for zero-shot joint distributional forecasting in multivariate time-series techniques. By producing coherent future eventualities in milliseconds, it permits real-time portfolio decision-making with out the lag of conventional numerical simulations. JointFM represents a paradigm shift in quantitative modeling: skilled on an infinite stream of dynamics from artificial stochastic differential equations (SDEs), JointFM acts as your digital quant.

Setting the stage: why quantitative modeling wants a brand new strategy

Modeling complicated techniques has historically required a painful trade-off. Classical quant strategies (like correlation copulas or coupled SDEs) provide excessive mathematical constancy however are inflexible, gradual, and costly. They usually require specialised groups to rebuild fashions every time the market regime or asset combine modifications. Conversely, present time-series basis fashions provide pace and suppleness however are single-target, lacking the vital cross-variable dependencies that outline systemic threat.

JointFM is your “digital quant“ to bridge this hole. Skilled on an infinite stream of artificial stochastic differential equations (SDEs), it learns the common physics of time-series dynamics, making it actually domain-agnostic. Whether or not for an influence grid or a inventory portfolio, it predicts the complete joint chance distribution of the system in milliseconds. That is the inspiration of immediate decision-making in extremely complicated setups and is quick sufficient to combine with brokers for ad-hoc enterprise choices.

On this challenge, we exhibit its energy in quantitative finance, constructing on NVIDIA’s quantitative portfolio optimization blueprint. JointFM permits immediate portfolio optimization (IPO), changing brittle in a single day batch processes with a digital quant that may rebalance portfolios in actual time and adapt to new property or market situations with out retraining.

Key takeaways

- The primary zero-shot basis mannequin for joint distributions: JointFM predicts full multivariate distributions out of the field, capturing correlations and tail threat.

- On the spot simulation at portfolio scale: 1000’s of coherent future eventualities are generated in milliseconds, impartial of portfolio complexity, enabling real-time decision-making and AI agent integration.

- Matches the risk-adjusted returns of the classical benchmark: throughout 200 managed artificial trials, JointFM achieved equal risk-adjusted efficiency.

- Pre-trained on artificial stochastic processes: by studying from thousands and thousands of generated dynamics, JointFM generalizes to new property and market situations with out retraining.

- From monetary modeling to monetary AI: JointFM replaces classical pipelines with a scalable, domain-agnostic basis mannequin.

The core problem: pace, constancy, and suppleness

In quantitative finance, portfolio managers have lengthy confronted a personalized trilemma:

- Quick however flawed: fashions like Geometric Brownian Movement (GBM) are computationally low cost however assume regular distributions and fixed correlations. They fail spectacularly throughout market crashes, when property develop into extremely correlated and fats tails seem.

- Correct however gradual: heavy Monte Carlo simulations with complicated copulas or regime-switching variations seize actuality higher however take for much longer to calibrate and run, making them impractical when you have to rebalance your portfolio on quick discover.

- Inflexible and costly: growing high-fidelity fashions requires specialised quantitative modeling groups, vital time, and cash. Worse, these fashions are sometimes brittle; when the market regime shifts otherwise you need to swap asset courses, you usually want to start out modeling once more from scratch.

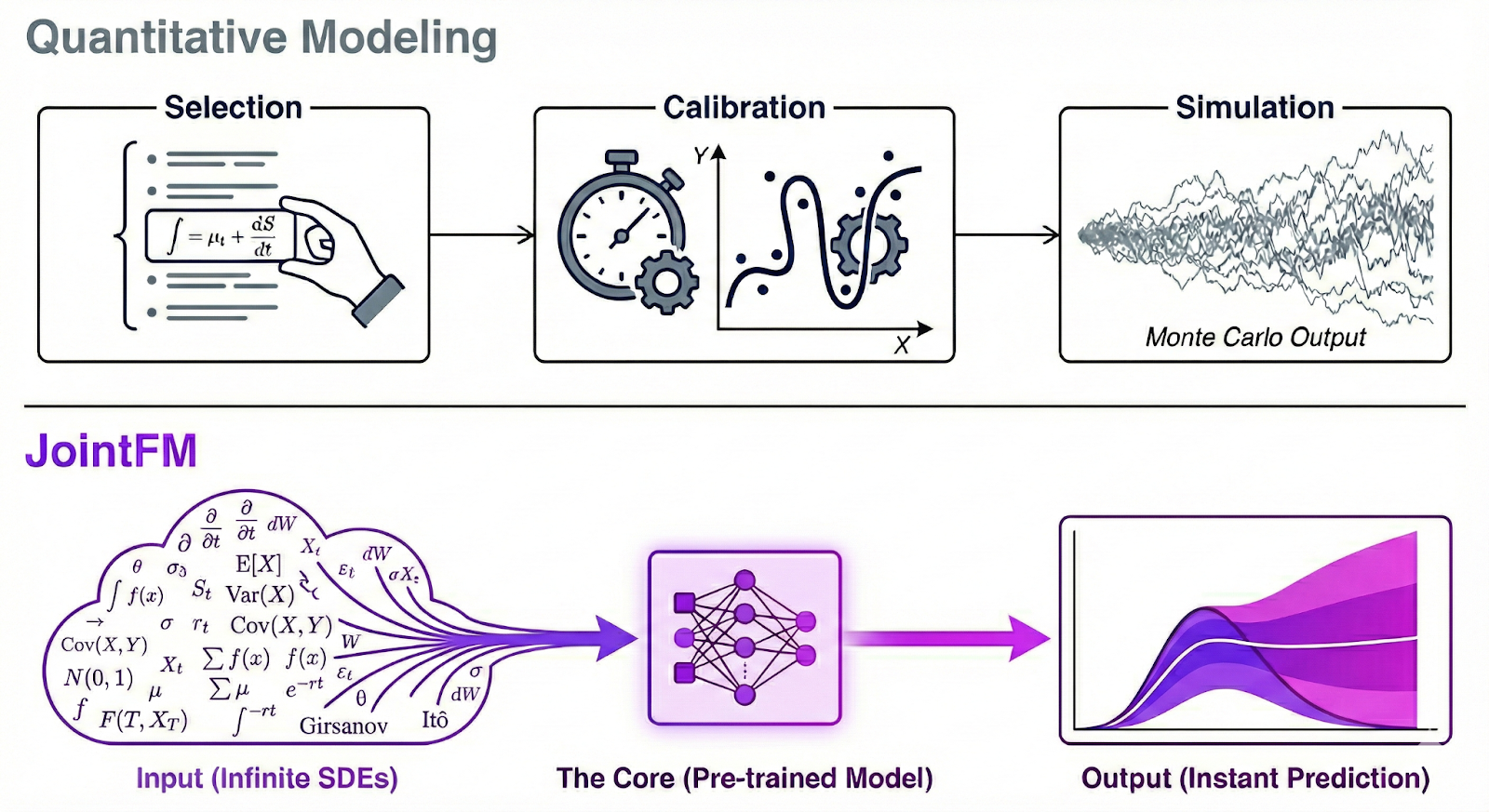

Enter JointFM: a basis mannequin for joint distributions

JointFM modifications the sport by “skipping” the modeling step. As an alternative of becoming parameters for every time collection every day, JointFM is a pre-trained mannequin that generalizes to unseen information out of the field. Whereas we apply it right here to monetary markets, the mannequin itself is domain-agnostic. It learns the language of stochastic processes, not simply inventory tickers.

The innovation

Till now, modeling joint distributions required vital compromises. You would outline complicated techniques of SDEs (mathematically tough), match specialised classical fashions to particular datasets (gradual and requiring retraining), or use copulas (bespoke and inflexible).

None of those are zero-shot.

However, present basis fashions are zero-shot however fail to seize cross-variable dependencies. JointFM is the primary to bridge this divide, providing the size and zero-shot pace of a basis mannequin with the mathematical depth of a rigorous joint chance framework.

This zero-shot functionality solves the rigidity downside. Dealing with a brand new market scenario the place you don’t know the underlying dynamics? Wish to swap difficult-to-model property immediately? JointFM works simply the identical. As a result of it has realized to foretell future joint distributions from virtually any dynamic throughout its numerous pre-training, it serves as the absolute best place to begin for unknown environments with out the necessity for a devoted quant workforce to construct a brand new mannequin from scratch.

Key capabilities

- Joint distributional forecasting: in contrast to customary univariate time-series fashions that predict marginal possibilities for one variable at a time, JointFM explicitly fashions the complete multivariate distribution of all variables concurrently. In finance, that is vital for diversification. You can not optimize a portfolio with out understanding how property transfer collectively.

- Zero-shot inference: no coaching required on the consumer’s information. The mannequin has already “seen all of it” throughout pre-training.

- State of affairs slicing: the mannequin can situation predictions on exogenous variables (e.g., “Present me the distribution of variables if an exterior issue rises”).

If you wish to learn extra about time-series and tabular basis fashions, take a look at this text on the brewing GenAI information science revolution, which provides an introduction to the sphere and explains why a mannequin like JointFM is the subsequent logical step.

Beneath the hood: structure & pace

JointFM leverages a specialised transformer-based structure designed to deal with the distinctive high-dimensional constraints of multivariate time collection.

1. Environment friendly high-dimensional context

To mannequin portfolios with many property over lengthy historical past home windows, JointFM strikes past the quadratic complexity of ordinary consideration mechanisms. Like different single-target fashions, JointFM employs a factored consideration technique that effectively decouples temporal dynamics from cross-variable dependencies. This enables the mannequin to scale linearly with the complexity of the portfolio, processing tons of of property with out turning into a computational bottleneck.

2. Heavy-tailed distributional heads

Actual-world information is never regular; it usually displays heavy tails and skewness. JointFM makes use of a versatile output layer able to parameterizing strong, fat-tailed multivariate distributions. This allows the mannequin to naturally seize the chance of utmost occasions (“black swans”) which can be vital for correct threat evaluation.

3. Parallel decoding for immediate outcomes

Pace is the central enabler of immediate portfolio optimization. Whereas additionally supporting an autoregressive mode, the mannequin structure is optimized for parallel decoding, permitting it to foretell all future horizons concurrently in a single ahead move. This functionality—distinct from the gradual, sequential technology of conventional autoregressive fashions—permits the technology of 1000’s of coherent market eventualities in milliseconds on a GPU.

The key sauce: artificial pre-training

Why does JointFM work so effectively on actual information with out seeing it? Artificial pre-training.

Actual historic information is usually finite, noisy, and regime-specific. To construct a very common basis mannequin, JointFM is skilled on an infinite curriculum of artificial information generated by a versatile engine. We lead with finance due to its notoriously complicated dynamics and its significance as a benchmark software for our work. Nevertheless, whereas the area is specialised, the core expertise is common.

- SDESampler: that is the core of the system. It generates complicated stochastic differential equations (SDEs) with jumps, complicated drifts, path-dependent reminiscence, and regimes. It’s designed to simulate any continuous-time system with stochastic parts.

- FinanceSampler: to handle the big selection of economic asset courses, we developed a specialised sampler that works alongside our generic engine. For the aim of this easy benchmark comparability, we restricted the choice to essentially the most elementary asset courses: equities, valuable metals, and overseas alternate (FX).

- Customized extensibility: whereas we targeted on finance, the identical structure permits us to construct different samplers (e.g., for climate, power, or sensor information) to focus on completely different domains.

This strategy exposes the mannequin to thousands and thousands of regimes, guaranteeing it learns the basic physics of time-series dynamics reasonably than simply memorizing historic patterns.

Efficiency analysis: benchmarking towards classical strategies

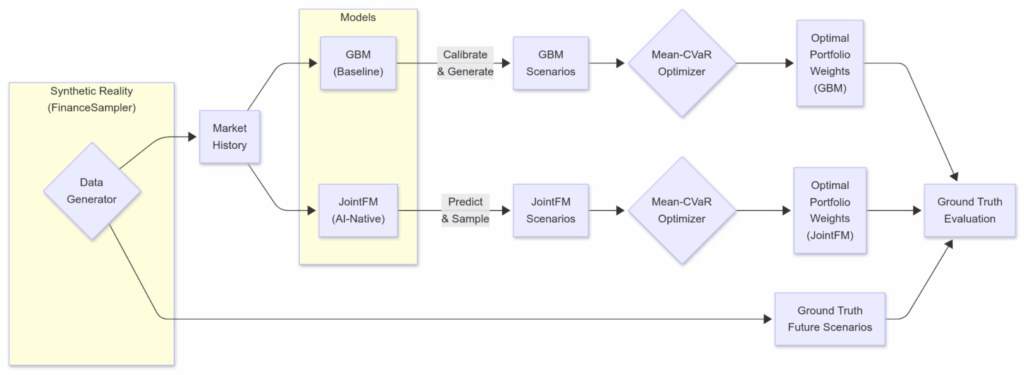

We in contrast JointFM-optimized portfolios towards classical Geometric Brownian Movement (GBM)-optimized portfolios as a easy baseline. Examine our experiment setup under, adopted by the outcomes.

Experimental setup

Our portfolio optimization setup, whereas drawing inspiration from the NVIDIA blueprint, incorporates just a few key variations. Just like the blueprint, we make the most of the identical GBM simulation and Imply-CVaR optimization however use JointFM in its place state of affairs generator and our FinanceSampler in addition to S&P 500 inventory costs as enter information.

- Enter:

- Artificial actuality: We generate complicated asset histories utilizing the FinanceSampler (SDEs with stochastic volatility, correlated drifts, and so on.). This ensures now we have a ground-truth multiverse of future prospects for goal analysis.

- Actual information (secondary examine): we additionally plug in actual historic returns (S&P 500) to substantiate the mannequin generalizes to the noisy, imperfect actual world.

- Inference:

- GBM—classical SDE calibration and path technology from the NVIDIA blueprint.

- JointFM—skilled on comparable however not equivalent artificial physics—generates 10,000+ believable future return eventualities in milliseconds. It successfully acts as a “future oracle” that intimately understands the statistical legal guidelines governing the property.

- Threat optimization:

- A Imply-CVaR (conditional worth in danger) optimizer solves for the portfolio weights that maximize risk-adjusted returns (balancing anticipated return towards tail threat).

- A Imply-CVaR (conditional worth in danger) optimizer solves for the portfolio weights that maximize risk-adjusted returns (balancing anticipated return towards tail threat).

- Execution and scoring:

- We deploy the optimum weights into the recognized future:

- Artificial ground-truth information gives 1000’s of eventualities for analysis per experiment step.

- Actual information has one recognized future for each historic experiment.

- We deploy the optimum weights into the recognized future:

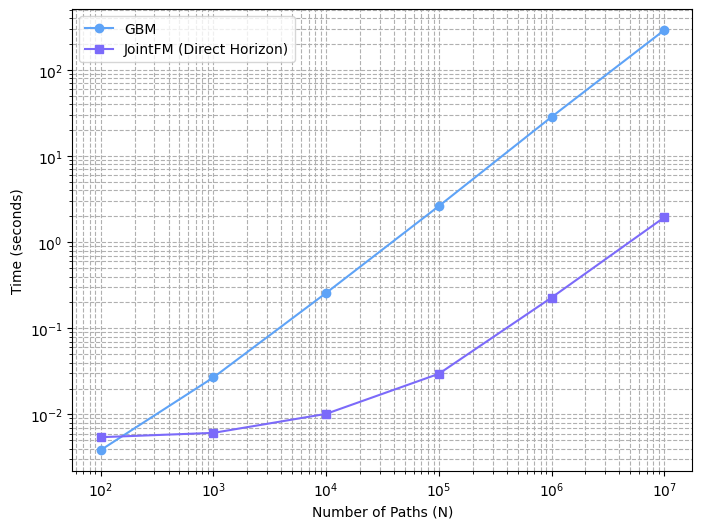

Pace: simulate the longer term immediately

JointFM generates eventualities in milliseconds, even orders of magnitude sooner than comparatively easy geometric Brownian movement (GBM) simulations.

This architectural benefit permits well timed reactions to market modifications and makes it sensible to combine refined simulation and portfolio optimization instantly into an AI agent. Consequently, buyers can discover and talk about funding choices in actual time with out further operational overhead.

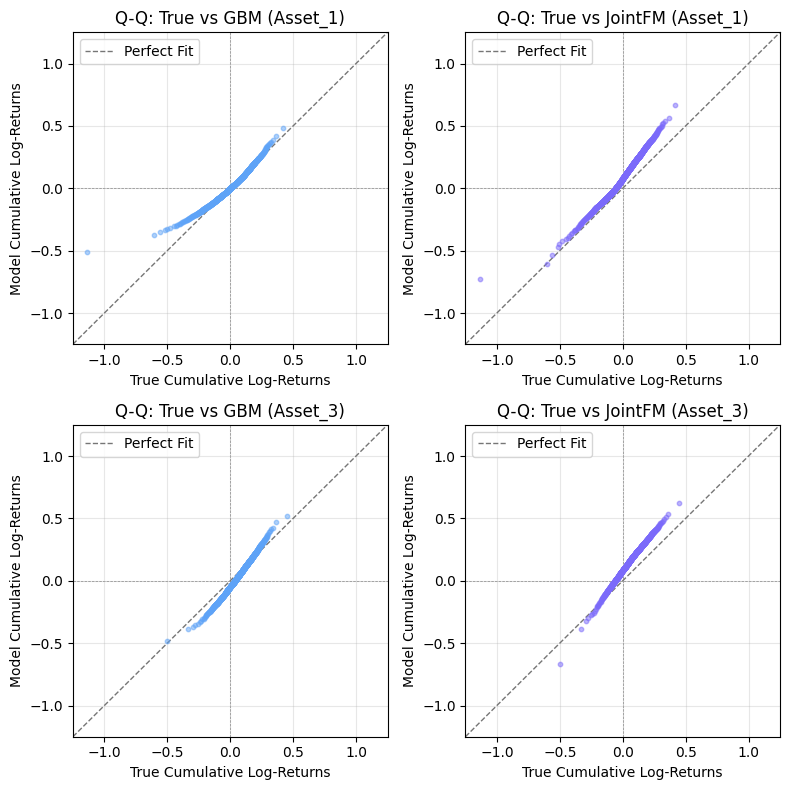

Efficiency on marginals: taking a look at one asset at a time

JointFM recovers the marginal distributions of complicated property to some extent. Under we present the Q-Q (quantile-quantile) plot for every percentile and two random property of 1 anecdotal simulation/prediction.

Whereas we clearly goal to additional enhance the marginal predictability, there are two issues right here which can be vital to grasp:

- The dynamics of economic property are notoriously arduous to foretell (right here 63 days forward).

- Being good at making marginal predictions alone doesn’t assist with threat administration very a lot. It’s vital to seize asset correlations as effectively.

Instantly evaluating high-dimensional joint chance distributions is impractical. As an alternative, we current a easy demonstration exhibiting that JointFM gives constant and dependable predictions for portfolio optimization, matching or exceeding the baseline quantitative methodology.

Portfolio analysis (artificial floor reality)

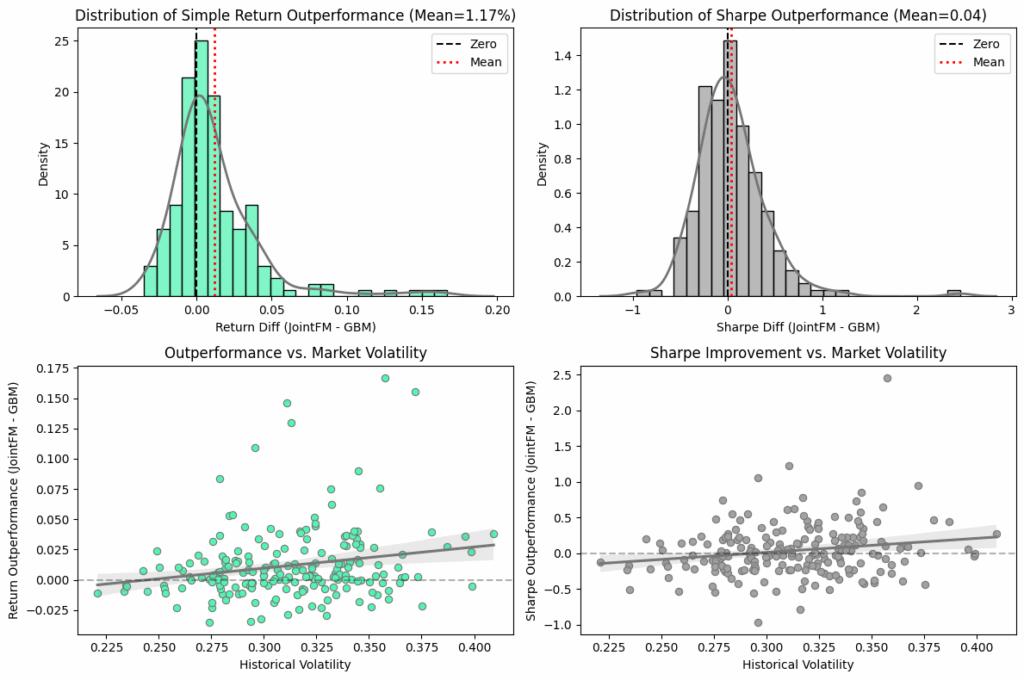

To scrupulously consider efficiency, we performed 200 repeated portfolio optimization trials utilizing artificial information wherein the true future joint distributions are recognized. This managed setting permits us to instantly evaluate JointFM-generated portfolios and our baseline towards the ground-truth optimum.

The outcomes

- Easy returns: JointFM portfolios achieved 1.17% greater returns on common.

- Threat-adjusted returns: the Sharpe ratio is virtually the identical. JointFM exhibits a barely higher risk-adjusted return.

On the artificial oracle information, the JointFM portfolio has a 1.17% greater return on common however at a roughly equivalent risk-adjusted return (Sharpe ratio), which implies that the outperformance resulted from extra risk-taking. Given its roughly equivalent efficiency when it comes to risk-adjusted return, which is the extra essential metric, our first model of JointFM emerges as a quick, low cost, versatile, and easy drop-in different to the baseline strategy.

Actual-world sanity examine

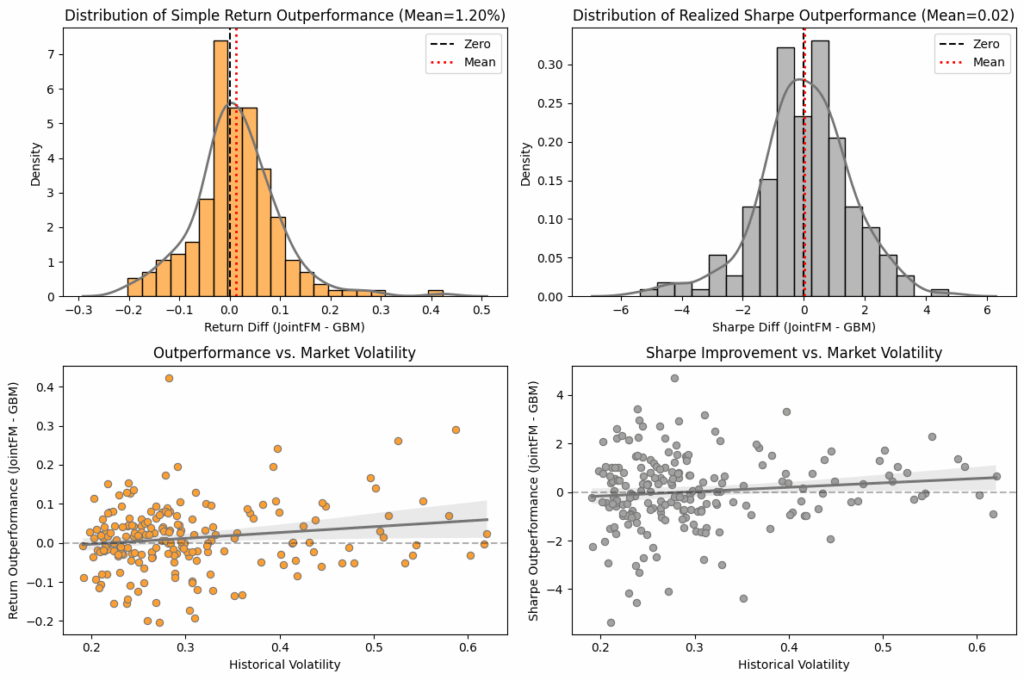

Addressing the potential concern that our mannequin is barely good at fixing the particular artificial issues it was skilled on, we validated the strategy on actual S&P 500 information (Yahoo Finance). We randomly sampled 10 property over 200 completely different time intervals out of a universe of 391 completely different shares from the S&P 500.

The outcomes

JointFM-portfolios, much like their efficiency on the artificial take a look at datasets, confirmed the next easy return. Their risk-adjusted return is roughly the identical because the comparability, barely outperforming it. This confirms that the mannequin has realized generalizable guidelines of volatility and correlation, not simply memorized a selected set of data-generating processes.

Wrapping up: immediate portfolio optimization

By changing inflexible statistical assumptions with a versatile, pre-trained basis mannequin, JointFM permits a brand new class of buying and selling and threat administration brokers. These brokers don’t simply react to cost modifications; they immediately re-simulate the longer term multiverse to search out the perfect path ahead. JointFM considerably accelerates inference by front-loading the in depth scientific modeling into the coaching stage. This enables for near-instantaneous inference execution.

This represents a shift from monetary modeling (becoming equations) to monetary AI (utilizing basis fashions), providing each the pace required for contemporary markets and the depth required for survival.

Ought to you could have any questions, please contact us at analysis@datarobot.com.