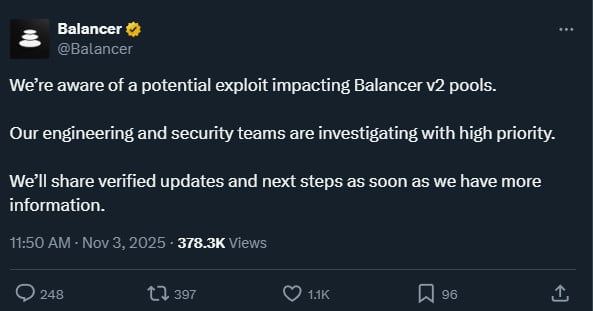

The Balancer Protocol introduced that hackers had focused its v2 swimming pools, with losses reportedly estimated to be greater than $128 million.

Balancer is a decentralized finance (DeFi) protocol constructed on the Ethereum blockchain as an automatic market maker and liquidity infrastructure layer.

It offers versatile swimming pools with customized token mixes, permitting customers to deposit property, earn charges, and let merchants swap property, and it’s ruled by the BAL token, which had a market cap of $65 million proper earlier than the incident.

Balancer has not shared many particulars in regards to the incident however warned customers to be cautious towards potential scams or phishing makes an attempt.

Balancer confirmed at this time that an exploit affected its V2 Compostable Secure Swimming pools at 7:48 AM UTC and that the difficulty doesn’t influence every other Balancer swimming pools, together with V3.

“Our workforce is working with main safety researchers to know the difficulty,” the firm stated in an replace just a few hours in the past.

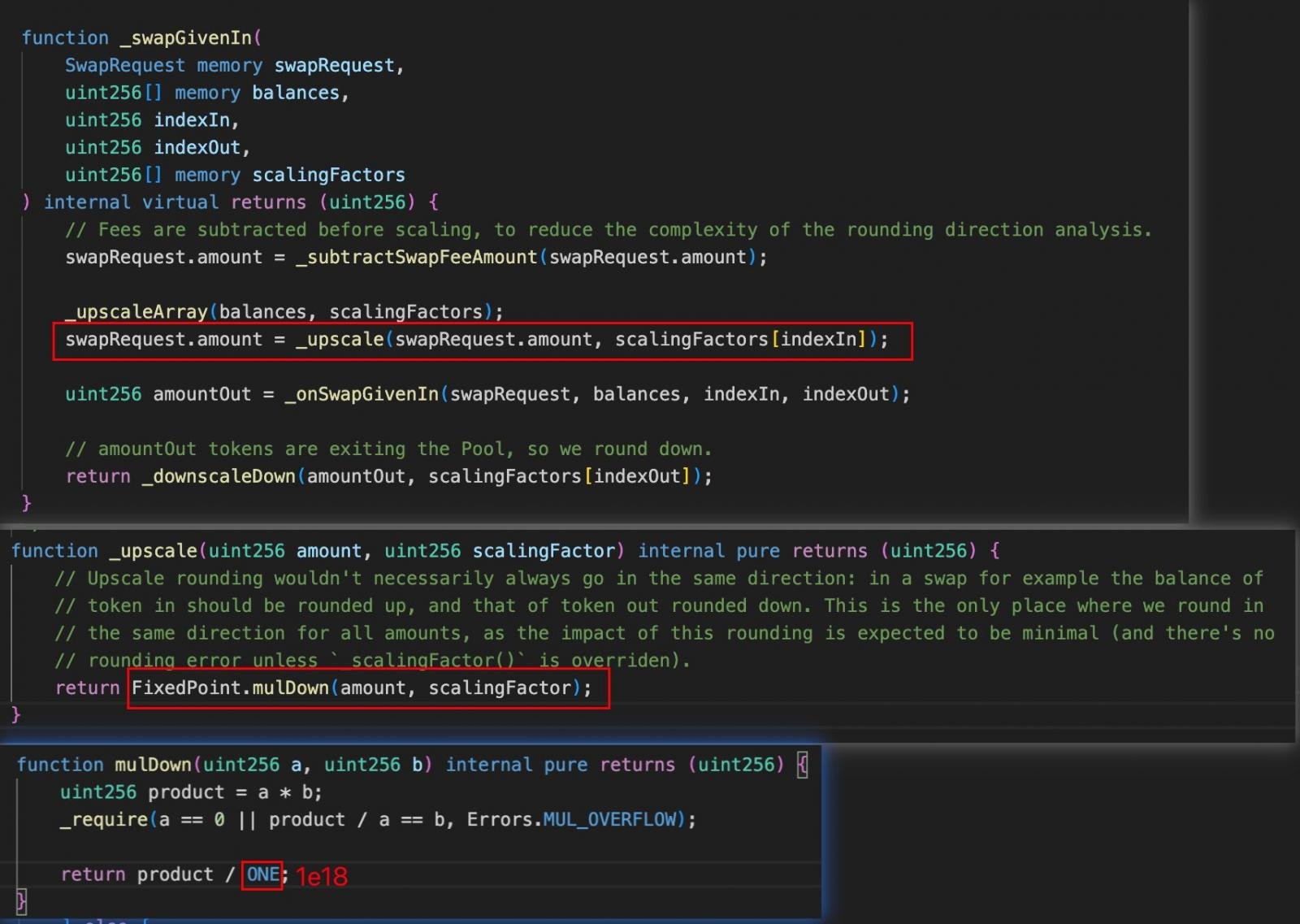

In line with GoPlus Safety, the Balancer V2 exploit stemmed from a precision rounding error within the Vault’s swap calculations.

Every swap operation rounded down token quantities, creating tiny discrepancies that the attacker may repeatedly exploit. By chaining a number of swaps by means of the batchSwap perform, these rounding losses compounded into a big worth distortion.

Supply: GoPlus Safety

Nonetheless, different customers claiming to know what occurred attribute the hack to improper authorization and callback dealing with inside Balancer’s V2 vaults.

In line with Aditya Bajaj, a maliciously deployed contract manipulated vault calls throughout pool initialization, successfully bypassing safeguards and enabling unauthorized swaps and stability manipulations throughout interconnected swimming pools.

Whereas there is no such thing as a settlement on the assault methodology but, Balancer promised to share extra particulars in regards to the hack “and a full autopsy as quickly as attainable.”

It’s value noting that Balancer V2 has been audited 11 occasions since 2021, with various examination scopes.

Try to trick the hacker

In the meantime, it seems that somebody tried to benefit from the state of affairs by impersonating Balancer and providing the hacker a “white-hat bounty” of 20% of the stolen quantity in the event that they agreed to return the remainder of the funds to a particular handle.

The phishing message is well-written and checks the tips to seem credible, together with the reward, a deadline, and a risk, all a part of a negotiation urgent for quick cooperation.

If the hacker refuses the deal, the fraudster impersonating Balancer threatens to use all info they’ve from blockchain forensics specialists, regulation enforcement businesses, and regulatory companions to establish and prosecute the attacker.

“Our companions have a excessive diploma of confidence you can be recognized from access-log metadata collected by our infrastructure, indicating connections from an outlined set of IP addresses/ASNs and related ingress timestamps that correlate with the transaction exercise on chain,” concludes the fraudulent message.

The Balancer hack is likely one of the largest cryptocurrency heists in 2025. Though there is no such thing as a attribution, the best risk to DeFi entities is North Korean hackers.

As of October 3, the quantity of cryptocurrency linked to North Korean thefts this yr had exceeded $2 billion, with the biggest by far being the Bybit assault in February, once they stole $1.5 billion in cryptocurrency.

It is price range season! Over 300 CISOs and safety leaders have shared how they’re planning, spending, and prioritizing for the yr forward. This report compiles their insights, permitting readers to benchmark methods, establish rising traits, and examine their priorities as they head into 2026.

Find out how high leaders are turning funding into measurable influence.