Let’s begin with a scene that’s in all probability acquainted. It’s the tip of the month, and a mountain of invoices has piled up on somebody’s desk—or, extra doubtless, of their inbox. Every one must be opened, learn, and its information manually keyed into an accounting system. It is a sluggish, tedious course of, liable to human error, and it’s a quiet bottleneck that prices companies a fortune in wasted time and assets.

For years, this was simply the price of doing enterprise. However what if invoices might simply… course of themselves?

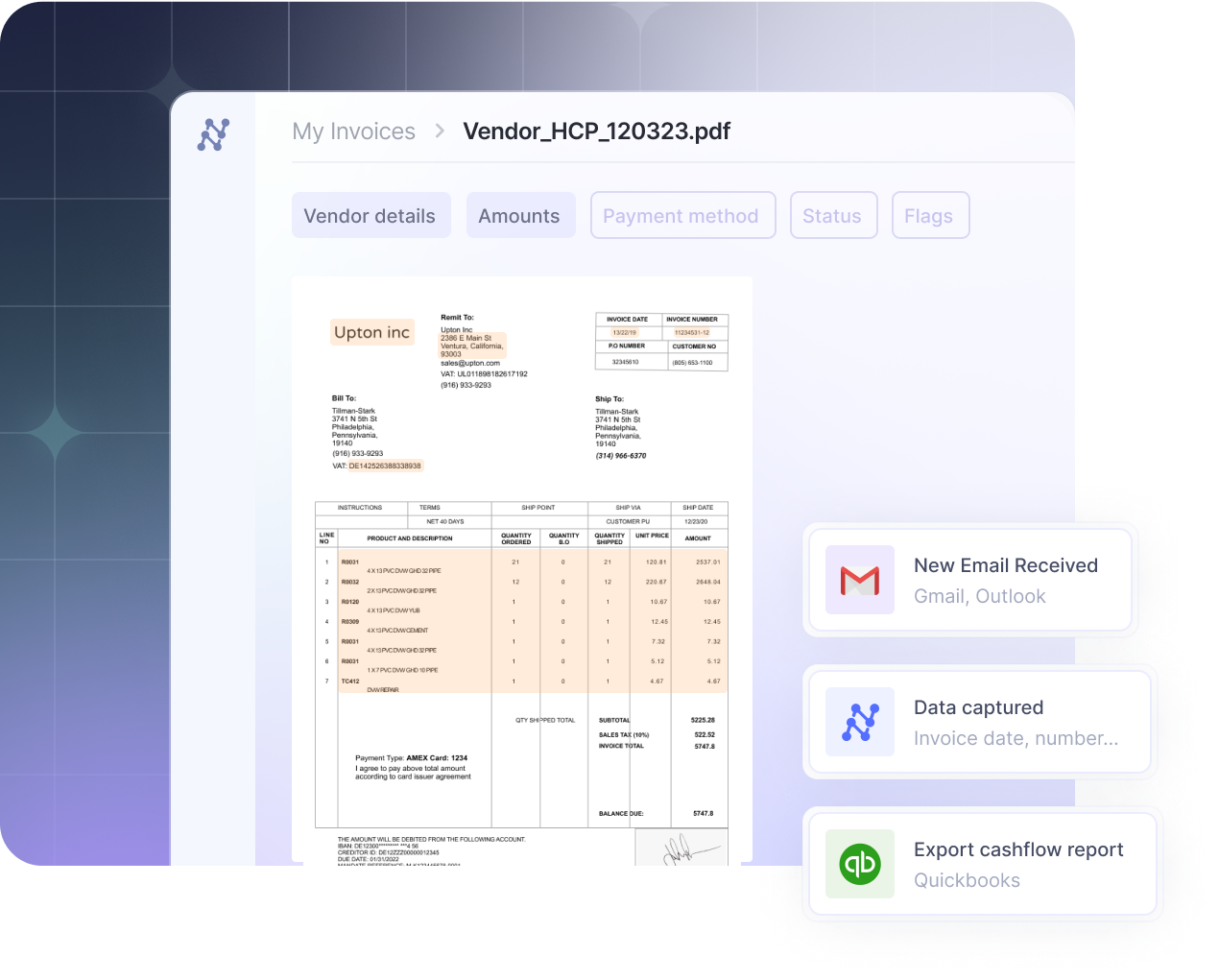

That’s the promise of recent bill information extraction. It’s not about simply scanning a doc; it’s about instructing a machine to learn, perceive, and course of an bill, in order that your AP staff can concentrate on extra strategic actions. On this information, we’ll break down how this expertise works, what to search for in an actual resolution, and present you the way we at Nanonets have been serving to firms all over the world course of invoices sooner and effectively.

What’s bill information extraction?

At its core, bill information extraction is the method of pulling key data like vendor names, bill numbers, line objects, and totals from an bill and structuring it for an accounting system or ERP. It’s the essential on-ramp for automating accounts payable, and its accuracy units the muse for all subsequent monetary record-keeping.

An in depth have a look at the bill information you’ll be able to extract

After we speak about “key data,” we’re referring to a variety of knowledge factors which might be essential for accounting and operations. A contemporary extraction software can seize dozens of fields, sometimes organized into these classes:

- Vendor data: Consists of the seller’s title, handle, contact particulars, and tax identification quantity (TIN).

- Bill specifics: This covers the distinctive bill quantity, the difficulty date, the fee due date, and any related buy order (PO) quantity.

- Line objects: An in depth, row-by-row breakdown of every services or products, together with its description, amount, unit value, and complete price.

- Totals and monetary information: The subtotal earlier than taxes, a breakdown of tax quantities (like VAT or GST), transport expenses, and the ultimate grand complete due.

- Cost phrases: Particulars on pay, together with fee technique, phrases like “Web 30,” and any out there early fee reductions.

Why your present bill course of might be costing you a fortune

The issue with handbook bill processing is not simply that it is tedious; it is that it is an extremely inefficient use of expert human capital like finance professionals. When an individual has to deal with every bill manually, the method is sluggish and costly.

Augeo, an accounting companies agency and one among our shoppers, discovered that their staff was spending 4 hours per day on handbook entry. After automating, that point was lower to simply half-hour.

The prices related to a handbook course of go far past simply the time spent on information entry:

- The hidden prices of errors: Guide information entry is liable to errors—research present error charges might be as excessive as 4%. A single misplaced decimal or incorrect vendor ID can result in overpayments, duplicate funds, or missed early fee reductions. The time your staff spends discovering and fixing these errors is a hidden operational price that drains productiveness.

- Excessive labor prices: Your staff’s time is a worthwhile useful resource, and handbook information entry is a big time sink. Business information exhibits that workers can spend almost half their workday on repetitive duties like this. Each hour spent manually keying in information is an hour not spent on strategic monetary evaluation, vendor administration, or figuring out cost-saving alternatives.

- It would not scale effectively: As your enterprise grows, the quantity of invoices grows with it. With a handbook course of, your solely resolution is so as to add extra headcount, immediately growing your payroll prices. This linear relationship between progress and overhead creates a serious bottleneck and prevents your finance operations from scaling effectively.

- Vulnerability to fraud: Guide programs lack the automated checks to simply spot suspicious exercise. A fraudulent bill, whether or not from an exterior phishing rip-off or an inside supply, can look authentic to a busy worker. With out automated validation in opposition to buy orders or vendor grasp recordsdata, these can slip via, resulting in direct monetary loss.

How bill information extraction really works

Automating bill extraction is not a brand new concept, however the expertise has developed considerably. Getting your information from a PDF into an ERP system should not really feel like attempting to navigate the asteroid discipline in The Empire Strikes Again.

The previous approach: the world of templates and guidelines

The primary era of automation relied on template-based, or Zonal OCR. Right here’s the way it works: for each vendor, an worker has to manually create a template, drawing fastened bins on a pattern bill. The rule is straightforward: “the bill quantity is at all times on this field, the date is at all times on this field.”

This class contains options from open-source libraries like invoice2data, which makes use of manually created templates, to legacy enterprise platforms like ABBYY and Tungsten.

When a brand new bill arrives from that very same vendor, the system applies the template and extracts textual content from these predefined coordinates.

The way it works: For each vendor, a developer creates a template by defining fastened coordinates or guidelines (like common expressions) for every discipline on a pattern bill. The system applies this inflexible template to extract information from subsequent invoices from that particular vendor.

This strategy is best than handbook entry, nevertheless it’s extremely brittle.

- It breaks with any change: If a vendor updates their bill format even barely—strikes the date, provides a brand—the template breaks, and the method fails.

- It requires large upkeep: You want a separate, manually-created template for each single vendor. As an example, within the case of one among our prospects, Suzano Worldwide, a number one Brazilian pulp and paper firm with over 70 prospects, it might imply creating and sustaining over 200 totally different automations to deal with all their doc codecs.

- It might’t deal with variation: It struggles with tables which have a variable variety of rows or non-compulsory fields that are not at all times current.

The LLM experiment: Can a common LLM deal with invoices?

With the rise of highly effective Massive Language Fashions (LLMs) like ChatGPT, Claude, or Gemini, a typical query is: “Cannot I simply use that?” The reply is sure, you’ll be able to add an bill picture to a common LLM and immediate it to extract the important thing fields right into a JSON format. It’s going to usually do a surprisingly first rate job.

The way it works: With a subscription to a service like ChatGPT Professional, a consumer can add an bill picture and write a immediate like: “Extract the invoice_number, invoice_date, vendor_name, and total_amount from this doc and supply the output in JSON format.”

Nevertheless, this isn’t a scalable enterprise resolution. Utilizing a general-purpose LLM for a selected, high-stakes enterprise course of like accounts payable has a number of essential flaws:

- It is a software, not a workflow: An LLM can extract information from a single doc, however it could possibly’t automate the end-to-end course of. It might’t routinely ingest invoices out of your e mail, run validation guidelines (like checking a PO quantity in opposition to your database), handle a multi-stage approval course of, or export information on to your ERP. It is a single, handbook step that also requires a human to handle the whole workflow round it.

- Inconsistent output: Whilst you can immediate an LLM to supply structured output, consistency is not assured. One time it would label a discipline invoice_id, the subsequent it is perhaps invoice_number. This lack of a set schema makes it unreliable for automated downstream integration, an issue customers have famous when attempting to construct dependable options.

- Information privateness issues: For many companies, importing delicate monetary paperwork containing vendor particulars, pricing, and financial institution data to a public, third-party AI mannequin is a big information safety and compliance danger.

- It would not be taught out of your information: A specialised software will get higher and extra correct in your distinctive use case over time as a result of it learns out of your staff’s corrections. A common LLM would not create a fine-tuned mannequin that’s repeatedly bettering primarily based in your particular wants.

Utilizing ChatGPT for bill processing is like utilizing a superb Swiss Military knife to construct a home. It might lower some wooden and switch some screws, nevertheless it’s no substitute for a devoted set of energy instruments designed for the job.

The efficient approach: Goal-built AI for context-aware extraction

Clever Doc Processing is the trendy, purpose-built resolution that mixes superior AI with a full suite of workflow instruments.

The way it works: IDP platforms are designed to be template-free. They use AI educated on thousands and thousands of paperwork to grasp the context and construction of an bill, whatever the format. This is how they work:

- Doc seize and pre-processing: The method begins by receiving an bill from any supply. The system then routinely cleans the doc picture, utilizing strategies like noise cleansing and skew correction to organize it for evaluation.

- Contextual evaluation: That is the place the true intelligence is available in. An AI mannequin would not simply learn phrases; it analyzes the whole doc’s DNA. It appears to be like at dozens of alerts concurrently: the precise place of a quantity on the web page, the sample of characters in a line, and the way totally different textual content blocks are aligned. This enables it to grasp context. For instance, the date on the high proper is the invoice_date, whereas a date in a desk is a service_date.

- No-template studying: This wealthy contextual information is fed right into a deep studying mannequin that has been educated on thousands and thousands of invoices. It learns the frequent patterns of invoices normally, which permits it to precisely extract information from a doc it has by no means seen earlier than with no need a pre-defined template.

- Validation and integration: After extraction, the information is routinely validated. The verified information is then seamlessly built-in into your accounting or ERP system.

That is usually enhanced with Zero-Shot Extraction, a cutting-edge functionality the place you’ll be able to instruct the AI to discover a new discipline with a easy textual content description, with no need to coach it on labeled examples.

When evaluating an answer, look previous the buzzwords and concentrate on these 4 core capabilities. A really efficient platform is way more than simply an OCR engine; it’s an entire operational software.

1. True AI, not simply old-school OCR

Probably the most essential characteristic is the power to deal with any bill format with no need customized templates. That is the core promise of AI. A template-less system dramatically reduces setup time and eliminates the upkeep nightmare of updating templates each time a vendor modifications their bill design.

2. A whole, customizable workflow

Information extraction is just one piece of the puzzle. An actual resolution automates the whole accounts payable workflow. This implies it should embrace strong options for every stage:

- Import: Versatile choices to get paperwork into the system, equivalent to through e mail, cloud storage, or API.

- Information actions: Instruments to scrub, format, and enrich the information after extraction.

- Approvals: The flexibility to construct multi-stage approval processes primarily based in your particular enterprise guidelines.

- Export: Seamless integration to ship the ultimate, accredited information to your accounting or ERP system.

3. Seamless integrations

The software should combine along with your current programs. Search for pre-built connectors for frequent software program like QuickBooks and SAP, and a versatile API and webhooks for customized programs.

4. Steady studying and enchancment

One of the best AI programs incorporate a “human-in-the-loop” studying mechanism. Because of this any correction a consumer makes is used as coaching information to enhance the mannequin. The platform ought to get progressively smarter and extra correct over time, lowering the necessity for handbook overview.

5. Assist agentic workflows

That is probably the most superior evolution of IDP. As an alternative of a passive software, an agentic platform is an autonomous system of specialised AI brokers that collaborate to execute the whole enterprise course of. Right here, a staff of digital brokers handles the workflow. A Classification Agent kinds incoming paperwork, an Extraction Agent pulls the information, a Validation Agent performs duties like three-way matching in opposition to buy orders, an Approval Agent routes it to the fitting individual, and a Posting Agent enters the ultimate information into the ERP. The purpose is to realize a excessive Straight-Via Processing (STP) charge, the place invoices movement from receipt to payment-readiness with zero human intervention.

A sensible information: Establishing your first automated bill workflow

Getting began with automation can really feel daunting, nevertheless it would not should be. Right here’s a extra detailed have a look at how one can arrange a robust workflow in Nanonets.

Step 1: Select your mannequin

Step one is to pick out the fitting AI mannequin. You may both use a pre-trained mannequin or practice a customized mannequin. For invoices, our pre-trained mannequin is one of the best place to start out, because it has been educated on thousands and thousands of numerous invoices and may acknowledge the most typical fields proper out of the field. The platform additionally intelligently identifies the doc sort—distinguishing an bill from a purchase order order—and routes it to the right workflow.

Step 2: Arrange your import channel

Subsequent, you must inform Nanonets the way it will obtain invoices. The commonest technique is to arrange an automatic e mail import. Nanonets supplies a singular e mail handle for every workflow you can auto-forward invoices to, so that they’ll be processed routinely.

Step 3: Configure your information actions

Uncooked extracted information usually wants refinement. That is the place “information actions” are available in. For instance, you’ll be able to add a “Date Formatter” motion to routinely standardize all extracted dates to a single format required by your ERP system. For our consumer ACM Companies, we arrange an motion to routinely search for a vendor’s GL code from a grasp file and add it to the extracted information.

Step 4: Construct your approval guidelines

That is the place you embed your organization’s enterprise logic. For instance, you would construct a two-stage approval:

- Stage 1 (PO Match): Use the “Match in Database” rule to examine if the PO quantity on the bill exists in your grasp record. If not, the bill is routinely flagged for overview.

- Stage 2 (Quantity Threshold): Add a second rule that states if the invoice_amount is bigger than $5,000, the bill additionally requires approval from a finance supervisor.

Step 5: Configure your export

The ultimate step is to get the clear, accredited information into your system of document. You may configure the export to attach on to your accounting software program, like QuickBooks, and map the extracted fields to the corresponding fields in your system.

What really units a contemporary platform aside is its skill to deal with your organization’s distinctive enterprise guidelines. At Nanonets, we developed a characteristic referred to as AI Agent Pointers that permits you to give the AI broad, plain-English directions to deal with context-specific eventualities. For instance:

- Vendor-specific logic: “If the seller is XYZ, then the invoice_amount doesn’t embrace taxes.”

- Regional guidelines: “If an bill is from Europe, the total_tax ought to embrace the sum of all VAT charges.”

Do not simply take our phrase for it: the proof is within the numbers

We’ve helped a whole bunch of firms remodel their accounts payable processes. Listed below are only a few examples:

- Asian Paints, one of many largest paint firms in Asia, lowered its doc processing time from 5 minutes to about 30 seconds, saving 192 person-hours each month.

- Suzano Worldwide automated the processing of buy orders from over 70 prospects, reducing the turnaround time from 8 minutes to simply 48 seconds—a 90% discount in time.

- Hometown Holdings, a property administration agency, saved 4,160 worker hours yearly and noticed a $40,000 improve in Web Working Earnings (NOI) after automating its property bill administration.

- Professional Companions Wealth, an accounting and wealth administration agency, achieved a straight-through processing charge of over 80% and saved 40% in time in comparison with their earlier OCR software.

Ultimate ideas

The transition from handbook bill processing to an automatic, AI-powered workflow is now not a luxurious—it is a strategic necessity. By leveraging AI to deal with the tedious, error-prone process of knowledge extraction, you release your finance staff to concentrate on higher-value actions like monetary evaluation and money movement administration.

Fashionable platforms like Nanonets present the instruments to not solely extract information with unimaginable accuracy however to automate the whole end-to-end course of. Should you’re able to cease the paper chase and construct a extra environment friendly finance operation, it is time to discover what AI-powered automation can do for you.

Discover how this integrates into scalable AI workflows in our information on – Automated Information Extraction for Enterprise AI.

FAQs

How is an Clever Doc Processing (IDP) platform totally different from a normal OCR software?

A typical OCR (Optical Character Recognition) software is only a digital transcriber that turns a picture into uncooked textual content, usually requiring inflexible templates. In distinction, an Clever Doc Processing (IDP) platform like Nanonets is an entire resolution that provides a layer of AI to grasp the doc’s context, eliminating the necessity for templates. It additionally manages the whole end-to-end enterprise course of—together with automated validation, multi-stage approvals, and seamless ERP integrations—all whereas studying from consumer corrections to grow to be extra correct over time.

What sort of accuracy and Straight-Via Processing (STP) charges are reasonable?

These are the 2 key metrics for measuring the success of an automation mission. For accuracy, fashionable AI-based programs can obtain 95-98%, which is a big leap from the 80-85% typical of older, template-based OCR. At Nanonets, we see this in follow with shoppers like ACM Companies, who’ve achieved 98.9% extraction accuracy on their invoices.

For Straight-Via Processing (STP)—the proportion of invoices processed with zero human intervention— goal for a well-implemented system is over 80%. This implies 8 out of 10 invoices can movement immediately out of your e mail inbox to your ERP, prepared for fee, with out anybody in your staff touching them. Our consumer Hometown Holdings, for instance, achieved an 88% STP charge.

How does the system deal with invoices in numerous languages and from totally different nations?

That is the place a contemporary, AI-driven platform really shines. In contrast to template-based programs that require a brand new algorithm for each format, an AI mannequin learns the elemental patterns of what an “bill” is, whatever the format.

- Dealing with totally different codecs: The AI’s skill to grasp context and analyze the doc’s construction means it could possibly adapt to totally different vendor layouts on the fly. This was a essential issue for our consumer Suzano Worldwide, who needed to course of paperwork in a whole bunch of various codecs.

- Dealing with totally different languages: Superior IDP platforms are educated on international datasets. The Nanonets platform, for instance, can course of paperwork in over 50 languages. Our work with JTI Ukraine, processing paperwork in Ukrainian, is a transparent instance of this international functionality in motion.

How is my delicate monetary information saved safe throughout this course of?

Safety for delicate monetary information is dealt with via a multi-layered strategy. All information on a platform like Nanonets is protected with encryption each in transit (utilizing TLS) and at relaxation. To make sure our processes meet the best requirements, our platform is compliant with certifications like SOC 2 and HIPAA, that are verified by impartial audits. That is all constructed on safe, licensed infrastructure, and your information isn’t used to coach fashions for different prospects. For organizations requiring most management, we additionally supply an on-premise deployment choice through a Docker occasion, guaranteeing no information ever leaves your individual surroundings.

Can this expertise automate different paperwork moreover invoices?

Completely. Whereas invoices are a main use case, the underlying AI and workflow expertise is designed to be document-agnostic. A key characteristic of the Nanonets platform is a Doc Classification module that may routinely establish and route totally different doc varieties to their distinctive workflows. Our consumer SafeRide Well being, for instance, makes use of this functionality to course of 16 several types of paperwork, together with car registrations and insurance coverage kinds, not simply invoices. This identical expertise might be simply configured for different frequent enterprise paperwork like buy orders, receipts, and payments of lading.