Welcome to the second a part of this two-part weblog collection on the bias-variance tradeoff and its software to buying and selling in monetary markets.

Within the first half, we tried to develop an instinct for the bias-variance decomposition. On this half, we’ll lengthen our learnings from the primary half and develop a buying and selling technique.

Conditions

You probably have some primary information of Python and ML, it’s best to have the ability to learn and comprehend the article. These are some pre-requisites:

- https://weblog.quantinsti.com/bias-variance-machine-learning-trading/

- Linear algebra (primary to intermediate)

- Python programming (primary to intermediate)

- Machine studying (working information of regression and regressor fashions)

- Time collection evaluation (primary to intermediate)

- Expertise in working with market knowledge and creating, backtesting, and evaluating buying and selling methods

Additionally, I’ve added some hyperlinks for additional studying at related locations all through the weblog.

In case you’re new to Python or want a refresher on it, you can begin with Fundamentals of Python Programming after which transfer to Python for Buying and selling: Fundamental on Quantra for trading-specific functions.

To familiarize your self with machine studying, and with the idea of linear regression, you may undergo Machine Studying for Buying and selling and Predicting Inventory Costs Utilizing Regression.

As a result of the article additionally covers time collection transformations and stationarity, you may familiarize your self with Time Sequence Evaluation. Information of dealing with monetary market knowledge and sensible expertise in technique creation, backtesting, and analysis will assist you apply the article’s learnings to your methods.

On this weblog, we’ll cowl the whole pipeline for utilizing machine studying to construct and backtest a buying and selling technique whereas utilising the bias-variance decomposition to pick the suitable prediction mannequin. So, right here goes…

The circulate of this text is as follows:

As a ritual, step one is to import the mandatory libraries.

Importing Libraries

In case you don’t have any of those put in, a ‘!pip set up’ command ought to do the trick (if you happen to don’t wish to go away the Jupyter Pocket book surroundings, or if you wish to work on Google Colab).

Downloading Knowledge

Subsequent, we outline a operate for downloading the info. We’ll use the yfinance API right here.

Discover the argument ‘multi_level_index’. Not too long ago (I’m scripting this in April 2025), there have been some modifications within the yfinance API. When downloading value stage and quantity knowledge for any safety via the required API, the ticker title of the safety will get added as a heading.

It appears like this when downloaded:

For individuals (like me!) who’re accustomed to not seeing this further stage of heading, eradicating it whereas downloading the info is a good suggestion. So we set the ‘multi_level_index’ argument to ‘False’.

Defining Technical Indicators as Predictor Variables

Subsequent, since we’re utilizing machine studying to construct a buying and selling technique, we should embody some options (typically known as predictor variables) on which we practice the machine studying mannequin. Utilizing technical indicators as predictor variables is a good suggestion when buying and selling within the monetary markets. Let’s do it now.

Ultimately, we’ll see the record of indicators after we name this operate on the asset dataframe.

Defining the Goal Variable

The subsequent chronological step is to outline the goal variable/s. In our case, we’ll outline a single goal variable, the close-to-close 5-day p.c return. Let’s see what this implies. Suppose at present is a Monday, and there aren’t any market holidays, barring the weekends, this week. Take into account the p.c change in tomorrow’s (Tuesday’s) closing value over at present’s closing value, which might be a close-to-close 1-day p.c return. At Wednesday’s shut, it will be the 2-day p.c return, and so forth, until the next Monday, when it will be the 5-day p.c return. Right here’s the Python implementation for a similar:

Why will we use the shift(-5) right here? Suppose the 5-day p.c return primarily based on the closing value of the next Monday over at present’s closing value is 1.2%. By utilizing shift(-5), we’re putting this worth of 1.2% within the row for at present’s OHLC value ranges, quantity, and different technical indicators. Thus, after we feed the info to the ML mannequin for coaching, it learns by contemplating the technical indicators as predictors and the worth of 1.2% in the identical row because the goal variable.

Stroll Ahead Optimization with PCA and VIF

One important consideration whereas coaching ML fashions is to make sure that they show strong generalization. Because of this the mannequin ought to have the ability to extrapolate its efficiency on the coaching dataset (typically known as in-sample knowledge) to the check dataset (typically known as out-of-sample knowledge), and its good (or in any other case) efficiency must be attributed primarily to the inherent nature of the info and the mannequin, relatively than to likelihood.

One strategy in the direction of that is combinatorial purged cross-validation with embargoing. You possibly can learn this to be taught extra.

One other strategy is walk-forward optimisation, which we’ll use (learn extra: 1 2).

One other important consideration whereas constructing an ML pipeline is characteristic extraction. In our case, the entire predictors we’ve got is 21. We have to extract an important ones from these, and for this, we’ll use Principal Element Evaluation and the Variance Inflation Issue. The previous extracts the highest 4 (a worth that I selected to work with; you may change it and see how the backtest modifications) combos of options that designate essentially the most variance inside the dataset, whereas the latter addresses mutual info, also referred to as multicollinearity.

Right here’s the Python implementation of constructing a operate that does the above:

Buying and selling Technique Formulation, Backtesting, and Analysis

We now come to the meaty half: the technique formulation. Listed here are the technique outlines:

Preliminary capital: ₹10,000.

Capital to be deployed per commerce: 20% of preliminary capital (₹2,000 in our case).

Lengthy situation: when the 5-day close-to-close p.c return prediction is constructive.

Brief situation: when the 5-day close-to-close p.c return prediction is unfavourable.

Entry level: open of day (N+1). Thus, if at present is a Monday, and the prediction for the 5-day close-to-close p.c returns is constructive at present, I’ll go lengthy at Tuesday’s open, else I’ll go quick at Tuesday’s open.

Exit level: shut of day (N+5). Thus, after I get a constructive (unfavourable) prediction at present and go lengthy (quick) throughout Tuesday’s open, I’ll sq. off on the closing value of the next Monday (offered there aren’t any market holidays in between).

Capital compounding: no. Because of this our income (losses) from each commerce should not getting added (subtracted) to (from) the tradable capital, which stays mounted at ₹10,000.

Right here’s the Python code for this technique:

Subsequent, we outline the features to guage the Sharpe ratio and most drawdowns of the technique and a buy-and-hold strategy.

Calling the Capabilities Outlined Beforehand

Now, we start calling a number of the features talked about above.

We’ll begin with downloading the info utilizing the yfinance API. The ticker and interval are user-driven. When operating this code, you’ll be prompted to enter the identical. I selected to work with the 10-year day by day knowledge of the NIFTY-50, the broad market index primarily based on the Nationwide Inventory Trade (NSE) of India. You possibly can select a smaller timeframe; the longer the timeframe, the longer it should take for the following codes to run. After downloading the info, we’ll create the technical indicators by calling the ‘create_technical_indicators’ operate we outlined beforehand.

Right here’s the output of the above code:

Enter a sound yfinance API ticker: ^NSEI Enter the variety of years for downloading knowledge (e.g., 1y, 2y, 5y, 10y): 10y YF.obtain() has modified argument auto_adjust default to True [*********************100%***********************] 1 of 1 accomplished

Subsequent, we align the info:

Let’s test the 2 dataframes ‘indicators’ and ‘data_merged’.

RangeIndex: 2443 entries, 0 to 2442 Knowledge columns (whole 21 columns): # Column Non-Null Depend Dtype --- ------ -------------- ----- 0 sma_5 2443 non-null float64 1 sma_10 2443 non-null float64 2 ema_5 2443 non-null float64 3 ema_10 2443 non-null float64 4 momentum_5 2443 non-null float64 5 momentum_10 2443 non-null float64 6 roc_5 2443 non-null float64 7 roc_10 2443 non-null float64 8 std_5 2443 non-null float64 9 std_10 2443 non-null float64 10 rsi_14 2443 non-null float64 11 vwap 2443 non-null float64 12 obv 2443 non-null int64 13 adx_14 2443 non-null float64 14 atr_14 2443 non-null float64 15 bollinger_upper 2443 non-null float64 16 bollinger_lower 2443 non-null float64 17 macd 2443 non-null float64 18 cci_20 2443 non-null float64 19 williams_r 2443 non-null float64 20 stochastic_k 2443 non-null float64 dtypes: float64(20), int64(1) reminiscence utilization: 400.9 KB

Index: 2438 entries, 0 to 2437 Knowledge columns (whole 28 columns): # Column Non-Null Depend Dtype --- ------ -------------- ----- 0 Date 2438 non-null datetime64[ns] 1 Shut 2438 non-null float64 2 Excessive 2438 non-null float64 3 Low 2438 non-null float64 4 Open 2438 non-null float64 5 Quantity 2438 non-null int64 6 sma_5 2438 non-null float64 7 sma_10 2438 non-null float64 8 ema_5 2438 non-null float64 9 ema_10 2438 non-null float64 10 momentum_5 2438 non-null float64 11 momentum_10 2438 non-null float64 12 roc_5 2438 non-null float64 13 roc_10 2438 non-null float64 14 std_5 2438 non-null float64 15 std_10 2438 non-null float64 16 rsi_14 2438 non-null float64 17 vwap 2438 non-null float64 18 obv 2438 non-null int64 19 adx_14 2438 non-null float64 20 atr_14 2438 non-null float64 21 bollinger_upper 2438 non-null float64 22 bollinger_lower 2438 non-null float64 23 macd 2438 non-null float64 24 cci_20 2438 non-null float64 25 williams_r 2438 non-null float64 26 stochastic_k 2438 non-null float64 27 Goal 2438 non-null float64 dtypes: datetime64[ns](1), float64(25), int64(2) reminiscence utilization: 552.4 KB

The dataframe ‘indicators’ accommodates all 21 technical indicators talked about earlier.

Bias-Variance Decomposition

Now, the first goal of this weblog is to reveal how the bias-variance decomposition can help in growing an ML-based buying and selling technique. After all, we aren’t simply limiting ourselves to it; we’re additionally studying the whole pipeline of making and backtesting an ML-based technique with robustness. However let’s discuss in regards to the bias-variance decomposition now.

We start by defining six totally different regression fashions:

You possibly can add extra or subtract a pair from the above record. The extra regressor fashions there are, the longer the following codes will take to run. Decreasing the variety of estimators within the related fashions can even end in sooner execution of the following codes.

In case you’re questioning why I selected regressor fashions, it’s as a result of the character of our goal variable is steady, not discrete. Though our buying and selling technique relies on the route of the prediction (bullish or bearish), we’re coaching the mannequin to foretell the 5-day return, a steady random variable, relatively than the market motion, which is a categorical variable.

After defining the fashions, we outline a operate for the bias-variance decomposition:

You possibly can lower the worth of num_rounds to, say, 10, to make the next code run sooner. Nonetheless, the next worth offers a extra strong estimate.

This can be a good repository to search for the above code:

https://rasbt.github.io/mlxtend/user_guide/consider/bias_variance_decomp/

Lastly, we run the bias-variance decomposition:

The output of this code is:

Bias-Variance Decomposition for All Fashions:

Whole Error Bias Variance Irreducible Error

LinearRegression 0.000773 0.000749 0.000024 -2.270048e-19

Ridge 0.000763 0.000743 0.000021 1.016440e-19

DecisionTree 0.000953 0.000585 0.000368 -2.710505e-19

Bagging 0.000605 0.000580 0.000025 7.792703e-20

RandomForest 0.000605 0.000580 0.000025 1.287490e-19

GradientBoosting 0.000536 0.000459 0.000077 9.486769e-20

Let’s analyse the above desk. We’ll want to decide on a mannequin that balances bias and variance, which means it neither underfits nor overfits. The choice tree regressor finest balances bias and variance amongst all six fashions.

Nonetheless, its whole error is the very best. Bagging and RandomForest show comparable whole errors. GradientBoosting shows not simply the bottom whole error but additionally the next diploma of variance in comparison with Bagging and RandomForest; thus, its capability to generalise to unseen knowledge must be higher than the opposite two, since it will seize extra advanced patterns..

You is perhaps compelled to suppose that with such proximity of values, such in-depth evaluation isn’t apt owing to a excessive noise-to-signal ratio. Nonetheless, since we’re operating 100 rounds of the bias-variance decomposition, we may be assured within the noise mitigation that outcomes.

Lengthy story reduce quick, we’ll select to coach the GradientBoosting regressor, and use it to foretell the goal variable. You possibly can, in fact, change the mannequin and see how the technique performs below the brand new mannequin. Please word that we’re treating the ML fashions as black packing containers right here, as exploring their underlying mechanisms is exterior the scope of this weblog. Nonetheless, when utilizing ML fashions for any use case, we should always all the time concentrate on their inside workings and select accordingly.

Having mentioned all of the above, is there a method of lowering the errors of a number of of the above regressor fashions? Sure, and it’s not a mere method, however an integral a part of working with time collection. Let’s talk about this.

Stationarizing the Inputs

We’re working with time collection knowledge (learn extra), and when performing monetary modeling duties, we have to test for stationarity (learn extra). In our case, we should always test our enter variables (the predictors) for stationarity.

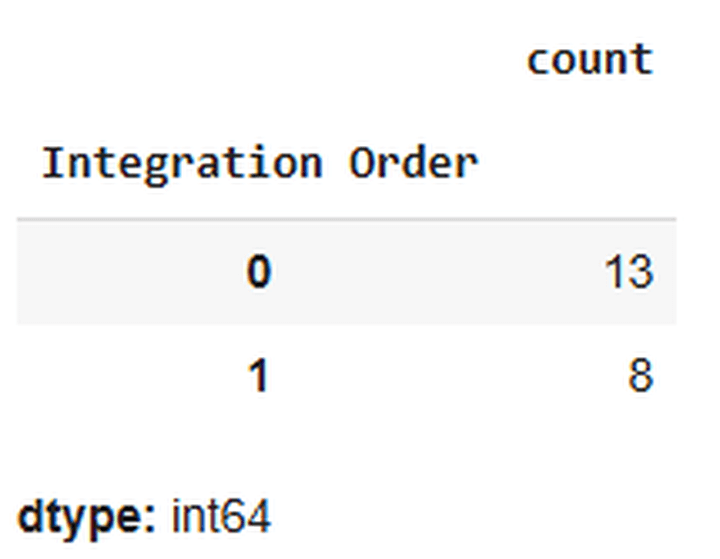

Let’s outline a operate to test the order of integration of the predictor variables. This operate would test whether or not we have to distinction the time collection (in our case, the predictor variables) and in that case, what number of instances (learn extra).

Let’s test the predictor variables for stationarity and apply differencing to the required predictors.

Right here’s the code:

Right here’s a snapshot of the output of the above code:

The above output signifies that 13 predictor variables don’t require stationarisation, whereas 8 do. Let’s stationarise them.

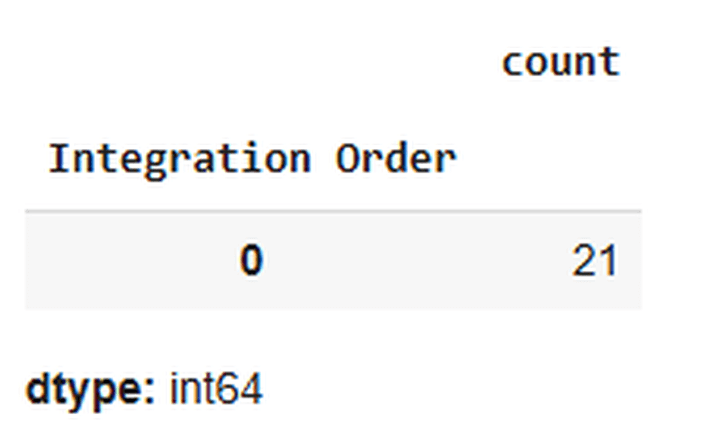

Let’s confirm whether or not the stationarising received performed as anticipated or not:

Yup, performed!

Let’s align the info once more:

Let’s test the bias-variance decomposition of the fashions with the stationarised predictors:

Right here’s the output:

Bias-Variance Decomposition for All Fashions with Stationarised Predictors:

Whole Error Bias Variance Irreducible Error

LinearRegression 0.000384 0.000369 0.000015 5.421011e-20

Ridge 0.000386 0.000373 0.000013 -3.726945e-20

DecisionTree 0.000888 0.000341 0.000546 2.168404e-19

Bagging 0.000362 0.000338 0.000024 -1.151965e-19

RandomForest 0.000363 0.000338 0.000024 7.453890e-20

GradientBoosting 0.000358 0.000324 0.000034 -3.388132e-20

There you go. Simply by following Time Sequence 101, we might scale back the errors of all of the fashions. For a similar purpose that we mentioned earlier, we’ll select to run the prediction and backtesting utilizing the GradientBoosting regressor.

Operating a Prediction utilizing the Chosen Mannequin

Subsequent, we run a walk-forward prediction utilizing the chosen mannequin:

Now, we create a dataframe, ‘final_data’, that accommodates solely the open costs, shut costs, precise/realised 5-day returns, and 5-day returns predicted by the mannequin. We’d like the open and shut costs for coming into and exiting trades, and the anticipated 5-day returns, to find out the route by which we take trades. We then name the ‘backtest_strategy’ operate on this dataframe.

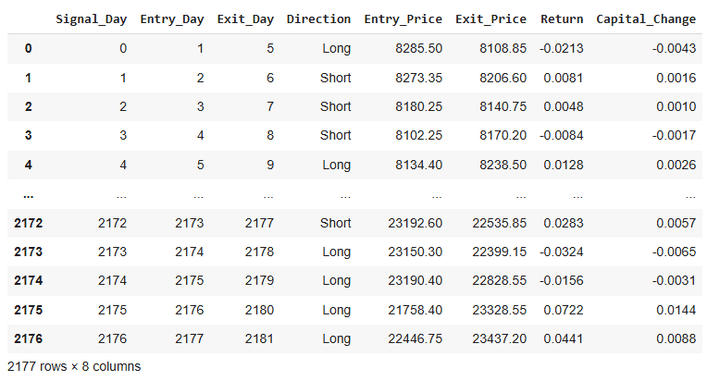

Checking the Commerce Logs

The dataframe ‘trades_df_differenced’ accommodates the commerce logs.

We’ll convert the decimals of the values within the dataframe for higher visibility:

Let’s test the dataframe ‘trades_df_differenced’ now:

Right here’s a snapshot of the output of this code:

From the desk above, it’s obvious that we take a brand new commerce day by day and deploy 20% of our tradeable capital on every commerce.

Fairness Curves, Sharpe, Drawdown, Hit Ratio, Returns Distribution, Common Returns per Commerce, and CAGR

Let’s calculate the fairness for the technique and the buy-and-hold strategy:

Subsequent, we calculate the Sharpe and the utmost drawdowns:

The above code requires you to enter the risk-free price of your selection. It’s usually the federal government treasury yield. You possibly can look it up on-line in your geography. I selected to work with a worth of 6.6:

Enter the risk-free price (e.g., for five.3%, enter solely 5.3): 6.6

Now, we’ll reindex the dataframes to a datetime index.

We’ll plot the fairness curves subsequent:

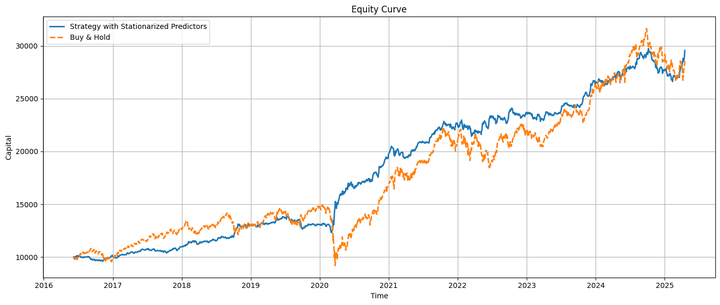

That is how the technique and buy-and-hold fairness curves look when plotted on the identical chart:

The technique fairness and the underlying transfer nearly in tandem, with the technique underperforming earlier than the COVID-19 pandemic and outperforming afterward. Towards the tip, we’ll talk about some lifelike concerns about this relative efficiency.

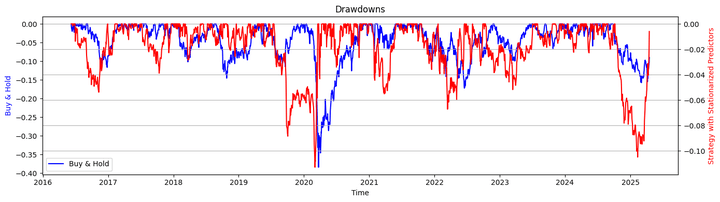

Let’s take a look on the drawdowns of the technique and the buy-and-hold strategy:

Let’s check out the Sharpe ratios and the utmost drawdown by calling the respective features that we outlined earlier:

Output:

Sharpe Ratio (Technique with Stationarised Predictors): 0.89 Sharpe Ratio (Purchase & Maintain): 0.42 Max Drawdown (Technique with Stationarised Predictors): -11.28% Max Drawdown (Purchase & Maintain): -38.44%

Right here’s the hit ratio:

Hit Ratio of Technique with Stationarised Predictors: 54.09%

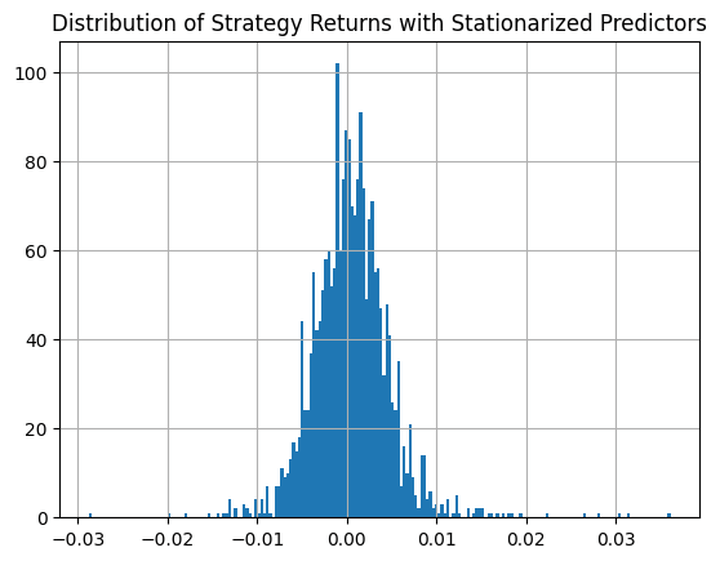

That is how the distribution of the technique returns appears like:

Lastly, let’s calculate the common income (losses) per profitable (shedding) commerce:

Common Revenue for Worthwhile Trades with Stationarised Predictors: 0.0171 Common Loss Loss-Making Trades with Stationarised Predictors: -0.0146

Primarily based on the above commerce metrics, we revenue extra on common in every commerce than we lose. Additionally, the variety of constructive trades exceeds the variety of unfavourable trades. Subsequently, our technique is protected on each fronts. The utmost drawdown of the technique is proscribed to 10.48%.

The explanation: The holding interval for any commerce is 5 days, utilizing solely 20% of our obtainable capital per commerce. This additionally reduces the upside potential per commerce. Nonetheless, for the reason that common revenue per worthwhile commerce is greater than the common loss per loss-making commerce and the variety of worthwhile trades is greater than the variety of loss-making trades, the probabilities of capturing extra upsides are greater than these of capturing extra downsides.

Let’s calculate the compounded annual progress price (CAGR):

CAGR (Purchase & Maintain): 13.0078% CAGR (Technique with Stationarised Predictors): 13.3382%

Lastly, we’ll consider the regressor mannequin’s accuracy, precision, recall, and f1 scores (learn extra).

Confusion Matrix (Stationarised Predictors): [[387 508] [453 834]] Accuracy (Stationarised Predictors): 0.5596 Recall (Stationarised Predictors): 0.6480 Precision (Stationarised Predictors): 0.6215 F1-Rating (Stationarised Predictors): 0.6345

Some Practical Concerns

Our technique outperformed the underlying index through the post-COVID-19 crash interval and marginally outperformed the general market. Nonetheless, if you’re pondering of utilizing the skeleton of this technique to generate alphas, you’ll have to peel off some assumptions and keep in mind some lifelike concerns:

Transaction Prices: We enter and exit trades day by day, as we noticed earlier. This incurs transaction prices.

Asset Choice: We backtested utilizing the broad market index, which isn’t immediately tradable. We’ll want to decide on ETFs or derivatives with this index because the underlying. The technique’s efficiency would even be topic to the inherent traits of the asset that we determine to commerce as a proxy for the broad market index.

Slippages: We enter our trades on the market’s opening and exit at its shut. Buying and selling exercise may be excessive throughout these durations, and we could encounter appreciable slippages.

Availability of Partially Tradable Securities: Our backtest implicitly assumes the supply of fractional property. For instance, if our capital is ₹2,000 and the entry value is ₹20,000, we’ll have the ability to purchase or promote 0.1 models of the underlying, ignoring all different prices.

Taxes: Since we’re coming into and exiting trades inside very quick time frames, other than transaction fees, we might incur a big quantity of short-term capital features tax (STCG) on the income earned. This, in fact, would rely in your native laws.

Threat Administration: Within the backtest, we omitted stop-losses and take-profits. You’re inspired to incorporate them and tell us your findings on how the technique’s efficiency will get modified.

Occasion-driven Backtesting: The backtesting we carried out above is vectorized. Nonetheless, in actual life, tomorrow comes solely after at present, and we should take into account this when performing a backtest. You possibly can discover the Blueshift at https://blueshift.quantinsti.com/ and take a look at backtesting the above technique utilizing an event-driven strategy (learn extra). An event-driven backtest would additionally account for slippage, transaction prices, implementation shortfalls, and threat administration.

Technique Efficiency: The hit ratio of the technique and the mannequin’s accuracy are roughly 54% and 56%, respectively. These values are marginally higher than these of a coin toss. You must do this technique with different asset lessons and solely choose these property on which these values are at the least 60% (or greater if you happen to wanna be extra conservative). Solely after that ought to you carry out an event-driven backtesting utilizing this technique define.

A Word on the Downloadable Python Pocket book

The downloadable pocket book includes backtesting the technique and evaluating its efficiency and the mannequin’s efficiency parameters in a situation the place the predictors should not stationarised and after stationarising them (as we noticed above). Within the former, the technique considerably outperforms the underlying mannequin, and the mannequin shows higher accuracy in its predictions regardless of its greater errors displayed through the bias-variance decomposition. Thus, a well-performing mannequin needn’t essentially translate into a great buying and selling technique, and vice versa.

The Sharpe of the technique with out the predictors stationarised is 2.56, and the CAGR is sort of 27% (versus 0.94 and 14% respectively when the predictors are stationarised). Since we used GradientBoosting, a tree-based mannequin that does not essentially want the predictor variables to be stationarised, we will work with out stationarising the predictors and reap the advantages of the mannequin’s excessive efficiency with non-stationarised predictors.

Word that operating the pocket book will take a while. Additionally, the performances you get hold of will differ a bit from what I’ve proven all through the article.

There’s no ‘Good’ in Goodbye…

…but, I’ll should say so now 🙂. Check out the backtest with totally different property by altering a number of the parameters talked about within the weblog, and tell us your findings. Additionally, as we all the time say, since we aren’t a registered funding advisory, any technique demonstrated as a part of our content material is for demonstrative, academic, and informational functions solely, and shouldn’t be construed as buying and selling or funding recommendation. Nonetheless, if you happen to’re in a position to incorporate all of the aforementioned lifelike components, extensively backtest and ahead check the technique (with or with out some tweaks), generate vital alpha, and make substantial returns by deploying it within the markets, do share the excellent news with us as a remark under. We’ll be joyful in your success 🙂. Till subsequent time…

Credit

José Carlos Gonzáles Tanaka and Vivek Krishnamoorthy, thanks in your meticulous suggestions; it helped form this text!

Chainika Thakar, thanks for rendering this and making it obtainable to the world!

Subsequent Steps

After going via the above, you may observe a number of structured studying paths if you wish to broaden and/or deepen your understanding of buying and selling mannequin efficiency, ML technique improvement, and backtesting workflows.

To grasp every part of this technique — from Python and PCA to stationarity and backtesting — discover topic-specific Quantra programs like:

For these aiming to consolidate all of this data right into a structured, mentor-led format, the Government Programme in Algorithmic Buying and selling (EPAT) presents a really perfect subsequent step. EPAT covers all the pieces from Python and statistics to machine studying, time collection modeling, backtesting, and efficiency metrics analysis — equipping you to construct and deploy strong, data-driven methods at scale.

File within the obtain:

- Bias Variance Decomposition – Python pocket book

Be happy to make modifications to the code as per your consolation.

All investments and buying and selling within the inventory market contain threat. Any determination to put trades within the monetary markets, together with buying and selling in inventory or choices or different monetary devices is a private determination that ought to solely be made after thorough analysis, together with a private threat and monetary evaluation and the engagement {of professional} help to the extent you consider obligatory. The buying and selling methods or associated info talked about on this article is for informational functions solely.