By Vivek Krishnamoorthy and Aacashi Nawyndder

TL;DR

Bayesian statistics affords a versatile, adaptive framework for making buying and selling choices by updating beliefs with new market knowledge. In contrast to conventional fashions, Bayesian strategies deal with parameters as chances, making them best for unsure, fast-changing monetary markets.

They’re utilized in threat administration, mannequin tuning, classification, and incorporating knowledgeable views or different knowledge. Instruments like PyMC and Bayesian optimisation make it accessible for quants and merchants aiming to construct smarter, data-driven methods.

This weblog covers:

Need to ditch inflexible buying and selling fashions and actually harness the ability of incoming market data? Think about a system that learns and adapts, identical to you do, however with the precision of arithmetic. Welcome to the world of Bayesian statistics, a game-changing framework for algorithmic merchants. It’s all about making knowledgeable choices by logically mixing what you already know with what the market is telling you proper now.

Let’s discover how this will sharpen your buying and selling edge!

This strategy contrasts with the standard, or “frequentist,” view of likelihood, which frequently sees chances as long-run frequencies of occasions and parameters as mounted, unknown constants (Neyman, 1937).

Bayesian statistics, then again, treats parameters themselves as random variables about which we are able to have beliefs and replace them as extra knowledge is available in (Gelman et al., 2013). Truthfully, this feels tailored for buying and selling, would not it? In any case, market circumstances and relationships are infrequently set in stone. So, let’s leap in and see how you should utilize Bayesian stats to get a leg up within the fast-paced world of finance and algorithmic buying and selling.

Conditions

To completely grasp the Bayesian strategies mentioned on this weblog, it is very important first set up a foundational understanding of likelihood, statistics, and algorithmic buying and selling.

For a conceptual introduction to Bayesian statistics, Bayesian Inference Strategies and Equation Defined with Examples affords an accessible rationalization of Bayes’ Theorem and the way it applies to uncertainty and decision-making, foundational to making use of Bayesian fashions in markets.

What You may Be taught:

- The core thought behind Bayesian pondering is updating beliefs with new proof.

- Understanding Bayes’ Theorem: your mathematical software for perception updating.

- Why Bayesian strategies are an amazing match for the uncertainties of economic markets.

- Sensible examples of Bayesian statistics in algorithmic buying and selling:

- Estimating mannequin parameters that adapt to new knowledge.

- Constructing easy predictive fashions (like Naive Bayes for market course).

- Incorporating knowledgeable views or different knowledge into your fashions.

- The Execs, Cons, and Current Tendencies of Utilizing Bayesian Approaches in Quantitative Finance.

The Bayesian Fundamentals

Prior Beliefs, New Proof, Up to date Beliefs

Okay, let’s break down the basic magic of Bayesian statistics. At its core, it is constructed on a splendidly easy but extremely highly effective thought: our understanding of the world just isn’t static; it evolves as we collect extra data.

Give it some thought like this: you have bought a brand new buying and selling technique you are mulling over.

- Prior Perception (Prior Chance): Primarily based in your preliminary analysis, backtesting on historic knowledge, or perhaps a hunch, you will have some preliminary perception about how worthwhile this technique is perhaps. For example you assume there is a 60% likelihood it is going to be worthwhile. That is your prior.

- New Proof (Probability): You then deploy the technique on a small scale or observe its hypothetical efficiency over just a few weeks of dwell market knowledge. This new knowledge is your proof. The chance operate tells you ways possible this new proof is, given completely different underlying states of the technique’s true profitability.

- Up to date Perception (Posterior Chance): After observing the brand new proof, you replace your preliminary perception. If the technique carried out nicely, your confidence in its profitability would possibly enhance from 60% to, say, 75%. If it carried out poorly, it’d drop to 40%. This up to date perception is your posterior.

This entire strategy of tweaking your beliefs primarily based on new data is neatly wrapped up and formalised by what is known as the Bayes’ Theorem.

Bayes’ Theorem: The Engine of Bayesian Studying

So, Bayes’ Theorem is the precise formulation that ties all these items collectively. You probably have a speculation (let’s name it H) and a few proof (E), the theory seems to be like this:

Bayes’ Theorem:

( P(H mid E) = frac{P(E mid H) cdot P(H)}{P(E)} )

The place:

- P(H|E) is the Posterior Chance: The likelihood of your speculation (H) being true after observing the proof (E). That is what you need to calculate; your up to date perception.

- P(E|H) is the Probability: The likelihood of observing the proof (E) in case your speculation (H) have been true. For instance, in case your speculation is “this inventory is bullish,” how possible is it to see a 2% worth enhance right now?

- P(H) is the Prior Chance: The likelihood of your speculation (H) being true earlier than observing the brand new proof (E). That is your preliminary perception.

- P(E) is the Chance of the Proof (additionally referred to as Marginal Probability or Normalising Fixed): The general likelihood of observing the proof (E) below all attainable hypotheses. It is calculated by summing (or integrating) P(E|H) × P(H) over each attainable H. This ensures the posterior chances sum as much as 1.

Let’s attempt to make this much less summary with a fast buying and selling situation.

Instance: Is a Information Occasion Bullish for a Inventory?

Suppose an organization is about to launch an earnings report.

- Speculation (H): The earnings report will probably be considerably higher than anticipated (a “constructive shock”).

- Prior P(H): Primarily based on analyst chatter and up to date sector efficiency, you imagine there is a 30% likelihood of a constructive shock. So, P(H) = 0.30.

- Proof (E): Within the hour earlier than the official announcement, the inventory worth jumps 1%.

- Probability P(E|H): You recognize from previous expertise that if there is a genuinely constructive shock brewing, there is a 70% likelihood of seeing such a pre-announcement worth leap attributable to insider data or some sharp merchants catching on early. So, P(E|H) = 0.70.

- Chance of Proof P(E): This one’s a bit of extra concerned as a result of the worth may leap for different causes, too, proper? Possibly the entire market is rallying, or it is only a false hearsay. For example:

- The likelihood of the worth leap if it is a constructive shock (P(E|H)) is 0.70 (as above).

- The likelihood of the worth leap if it is not a constructive shock (P(E|not H)) is, say, 0.20 (it is much less possible, however attainable).

- Since P(H) = 0.30, then P(not H) = 1 – 0.30 = 0.70.

- So, P(E) = P(E|H)P(H) + P(E|not H)P(not H) = (0.70 * 0.30) + (0.20 * 0.70) = 0.21 + 0.14 = 0.35.

Now we are able to calculate the Posterior ( P(H mid E) ):

( P(H mid E) = frac{0.70 instances 0.30}{0.35} = frac{0.21}{0.35} = 0.60 )

Increase! After seeing that 1% worth leap, your perception that the earnings report will probably be a constructive shock has shot up from 30% to 60%! This up to date likelihood can then inform your buying and selling determination, maybe you are now extra inclined to purchase the inventory or regulate an current place.

After all, this can be a super-simplified illustration. Actual monetary fashions are juggling a considerably larger variety of variables and far more complicated likelihood distributions. However the lovely factor is, that core logic of updating your beliefs as new data is available in? That stays precisely the identical.

Why Bayesian Statistics Shines in Algorithmic Buying and selling

Monetary markets are a wild experience, stuffed with uncertainty, continuously altering relationships (non-stationarity, if you wish to get technical), and infrequently, not a number of knowledge for these actually uncommon, out-of-the-blue occasions. Bayesian strategies supply a number of benefits on this atmosphere:

- Handles Uncertainty Like a Professional: Bayesian statistics would not simply offer you a single quantity; it naturally offers with uncertainty by utilizing likelihood distributions for parameters, as a substitute of pretending they’re mounted, recognized values (Bernardo & Smith, 2000). This provides you a way more real looking image of what would possibly occur.

- Updating Beliefs with New Information: Algorithmic buying and selling methods continuously course of new market knowledge. Bayesian updating permits fashions to adapt dynamically. As an illustration, the volatility of an asset is not fixed; a Bayesian mannequin can replace its volatility estimate as new worth ticks arrive.

- Working with Small Information Units: Conventional frequentist strategies usually require giant pattern sizes for dependable estimates. Bayesian strategies, nevertheless, may give you fairly wise insights even with restricted knowledge, as a result of they allow you to usher in “informative priors” – mainly, your current information from specialists, comparable markets, or monetary theories (Ghosh et al., 2006). This can be a lifesaver while you’re making an attempt to mannequin uncommon occasions or new property that do not have a protracted historical past.

- Mannequin Comparability and Averaging: Bayesian strategies present a extremely stable means (e.g., utilizing Bayes components or posterior predictive checks) to check completely different fashions and even common out their predictions. This usually results in extra strong and dependable outcomes (Hoeting et al., 1999).

- Lets You Weave in Qualitative Insights: Acquired a robust financial motive why a sure parameter ought to in all probability fall inside a particular vary? Priors offer you a proper strategy to combine that sort of qualitative hunch or knowledgeable opinion together with your exhausting quantitative knowledge.

- Clearer Interpretation of Chances: When a Bayesian mannequin tells you “there is a 70% likelihood this inventory will go up tomorrow,” it means precisely what it appears like: it’s your present diploma of perception. This is usually a lot extra easy to behave on than making an attempt to interpret p-values or confidence intervals alone (Berger & Berry, 1988).

Sensible Bayesian Purposes in Algorithmic Buying and selling

Alright, sufficient idea! Let’s get right down to brass tacks. How are you going to truly use Bayesian statistics in your buying and selling algorithms?

1. Adaptive Parameter Estimation: Conserving Your Fashions Recent

So many buying and selling fashions lean closely on parameters – just like the lookback window in your shifting common, the velocity of imply reversion in a pairs buying and selling setup, or the volatility guess in an choices pricing mannequin. However right here’s the catch: market circumstances are all the time shifting, so parameters that have been golden yesterday is perhaps suboptimal right now.

That is the place Bayesian strategies are tremendous helpful. They allow you to deal with these parameters not as mounted numbers, however as distributions that get up to date as new knowledge rolls in. Think about you are estimating the typical each day return of a inventory.

- Prior: You would possibly begin with a obscure prior thought(e.g., a traditional distribution centred round 0 with a large unfold (normal deviation)) or a extra educated guess primarily based on how comparable shares within the sector have carried out traditionally.

- Probability: As every new buying and selling day supplies a return, you calculate the chance of observing that return given completely different attainable values of the true common each day return.

- Posterior: Bayes’ theorem combines the prior and chance to provide you an up to date distribution for the typical each day return. This posterior turns into the prior for the following day’s replace.It is a steady studying loop!

Scorching Development Alert: Strategies like Kalman Filters (that are inherently Bayesian) are extensively used for dynamically estimating unobserved variables, just like the “true” underlying worth or volatility, in noisy market knowledge (Welch & Bishop, 2006). One other space is Bayesian regression, the place the regression coefficients (e.g., the beta of a inventory) are usually not mounted factors however distributions that may evolve.

For extra on regression in buying and selling, you would possibly need to try how Regression is Utilized in Buying and selling.

Simplified Python Instance: Updating Your Perception a couple of Coin’s Equity (Assume Market Ups and Downs)

For example we need to get a deal with on the likelihood of a inventory worth going up (we’ll name it ‘Heads’) on any given day. This can be a bit like making an attempt to determine if a coin is honest or biased.

Python Code:

Output:

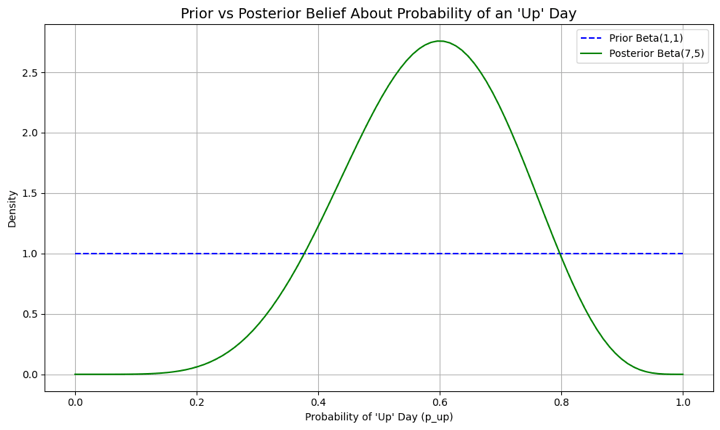

Preliminary Prior: Alpha=1, Beta=1 Noticed Information: 6 'up' days, 4 'down' days Posterior Perception: Alpha=7, Beta=5 Up to date Estimated Chance of an 'Up' Day: 0.58 95% Credible Interval for p_up: (0.31, 0.83)

On this code:

- We begin off with a Beta(1,1) prior, which is uniform and suggests any likelihood of an ‘up’ day is equally possible.

- Then, we observe 10 days of market knowledge with 6 ‘up’ days.

- The posterior distribution turns into Beta(1+6, 1+4) = Beta(7, 5).

- Our new level estimate for the likelihood of an ‘up’ day is 7 / (7+5) = 0.58, or 58%.

- The credible interval offers us a variety of believable values.

The graph supplies a transparent visible for this belief-updating course of. The flat blue line represents our preliminary, uninformative prior, the place any likelihood for an ‘up’ day was thought-about equally possible. In distinction, the orange curve is the posterior perception, which has been sharpened and knowledgeable by the noticed market knowledge. The height of this new curve, centered round 0.58, represents our up to date, most possible estimate, whereas its extra concentrated form signifies our decreased uncertainty now that now we have proof to information us.

This can be a toy instance, but it surely exhibits the mechanics of how beliefs get up to date. In algorithmic buying and selling, this could possibly be utilized to the likelihood of a worthwhile commerce for a given sign or the likelihood of a market regime persisting.

2. Naive Bayes Classifiers for Market Prediction: Easy however Surprisingly Good!

Subsequent up, let’s speak about Naive Bayes. It is a easy probabilistic classifier that makes use of Bayes’ theorem, however with a “naive” (or to illustrate, optimistic) assumption that each one your enter options are unbiased of one another. Regardless of its simplicity, it may be surprisingly efficient for duties like classifying whether or not the following day’s market motion will probably be ‘Up’, ‘Down’, or ‘Sideways’ primarily based on present indicators. (Rish, 2001)

Right here’s the way it works (conceptually):

- Outline Options: These could possibly be technical indicators (e.g., RSI < 30, MACD crossover), worth patterns (e.g., yesterday was an engulfing candle), and even sentiment scores from monetary information.

- Accumulate Coaching Information: Collect historic knowledge the place you will have these options and the precise consequence (Up/Down/Sideways).

- Calculate Chances from Coaching Information:

- Prior Chances of Outcomes: P(Up), P(Down), P(Sideways) – merely the frequency of those outcomes in your coaching set.

- Probability of Options given Outcomes: P(Feature_A | Up), P(Feature_B | Up), and many others. As an illustration, “What is the likelihood RSI < 30, given the market went Up the following day?”

- Make a Prediction: For brand new knowledge (right now’s options):

- Calculate the posterior likelihood for every consequence:

- P(Up | Options) ∝ P(Up) * P(Feature_A | Up) * P(Feature_B | Up) * …

- P(Down | Options) ∝ P(Down) * P(Feature_A | Down) * P(Feature_B | Down) * …

- (And equally for Sideways)

- The end result with the best posterior likelihood is your prediction.

Python Snippet Concept (Only a idea, you’d want sklearn for this):

Python Code:

Output:

Naive Bayes Classifier Accuracy (on dummy knowledge): 0.43

This accuracy rating of 0.43 signifies the mannequin accurately predicted the market’s course 43% of the time on the unseen take a look at knowledge. Since this result’s beneath 50% (the equal of random likelihood), it means that, with the present dummy knowledge and options, the mannequin doesn’t show predictive energy. In a real-world software, such a rating would sign that the chosen options or the mannequin itself is probably not appropriate, prompting a re-evaluation of the strategy or additional function engineering.

This little snippet offers you the fundamental movement. Constructing an actual Naive Bayes classifier for buying and selling takes cautious thought of which options to make use of (that is “function engineering”) and rigorous testing (validation). That “naive” assumption that each one options are unbiased may not be completely true within the messy, interconnected world of markets, but it surely usually offers you a surprisingly good place to begin or baseline mannequin.

Interested in the place to study all this? Don’t fear, pal, we’ve bought you lined! Try this course.

3. Bayesian Danger Administration (e.g., Worth at Danger – VaR)

You’ve got in all probability heard of Worth at Danger (VaR), it is a frequent strategy to estimate potential losses. However conventional VaR calculations can typically be a bit static or depend on simplistic assumptions. Bayesian VaR permits for the incorporation of prior beliefs about market volatility and tail threat, and these beliefs might be up to date as new market shocks happen. This will result in threat estimates which can be extra responsive and strong, particularly when markets get uneven.

As an illustration, if a “black swan” occasion happens, a Bayesian VaR mannequin can adapt its parameters far more rapidly to mirror this new, higher-risk actuality. A purely historic VaR, then again, would possibly take lots longer to catch up.

4. Bayesian Optimisation for Discovering Goldilocks Technique Parameters

Discovering these “good” parameters in your buying and selling technique (like the right entry/exit factors or the perfect lookback interval) can really feel like trying to find a needle in a haystack. Bayesian optimisation is a significantly highly effective method that may assist right here. It cleverly makes use of a probabilistic mannequin (usually a Gaussian Course of) to mannequin the target operate (like how worthwhile your technique is for various parameters) and selects new parameter units to check in a means that balances exploration (making an attempt new areas) and exploitation (refining recognized good areas) (Snoek et al., 2012). This may be far more environment friendly than simply making an attempt each mixture (grid search) or selecting parameters at random.

Scorching Development Alert:Bayesian optimisation is a rising star within the broader machine studying world and is extremely well-suited for fine-tuning complicated algorithmic buying and selling methods, particularly when operating every backtest takes a number of computational horsepower.

5. Weaving in Various Information and Skilled Hunches (Opinions)

Today, quants are more and more “different knowledge” sources, issues like satellite tv for pc photos, the overall temper on social media, or bank card transaction tendencies. Bayesian strategies offer you a extremely pure strategy to combine such numerous and infrequently unstructured knowledge with conventional monetary knowledge. You’ll be able to set your priors primarily based on how dependable or robust you assume the sign from another knowledge supply is.

And it is not nearly new knowledge varieties. What if a seasoned portfolio supervisor has a robust conviction a couple of explicit sector due to some geopolitical growth that is tough to quantify? That “knowledgeable opinion” can truly be formalised into a previous distribution, permitting it to affect the mannequin’s output proper alongside the purely data-driven alerts.

Current Trade Buzz in Bayesian Algorithmic Buying and selling

Whereas Bayesian strategies have been round in finance for some time, just a few areas are actually heating up and getting a number of consideration recently:

- Bayesian Deep Studying (BDL): You know the way conventional deep studying fashions offer you a single prediction however do not actually let you know how “certain” they’re? BDL is right here to alter that! It combines the ability of deep neural networks with Bayesian ideas to provide predictions with related uncertainty estimates (Neal, 1995; Gal & Ghahramani, 2016). That is essential for monetary purposes the place figuring out the mannequin’s confidence is as essential because the prediction itself. For instance, think about a BDL mannequin not simply predicting a inventory worth, but in addition saying it is “80% assured the worth will land between X and Y”.

- Probabilistic Programming Languages (PPLs): Languages like Stan, PyMC3 (Salvatier et al., 2016), and TensorFlow Chance are making it simpler for quants to construct and estimate complicated Bayesian fashions with out getting slowed down within the low-level mathematical particulars of inference algorithms like Markov Chain Monte Carlo (MCMC). This simpler entry is absolutely democratising using refined Bayesian strategies throughout the board (Carpenter et al., 2017).

- Subtle MCMC and Variational Inference: As our fashions get extra formidable, the computational grunt work wanted to suit them additionally grows. Fortunately, researchers are continuously cooking up extra environment friendly MCMC algorithms (like Hamiltonian Monte Carlo) and speedier approximate strategies like Variational Inference (VI) (Blei et al., 2017), making bigger Bayesian fashions tractable for real-world buying and selling.

If you wish to study extra about MCMC, QuantInsti has a wonderful weblog on Introduction to Monte Carlo Evaluation. - Dynamic Bayesian Networks for Recognizing Market Regimes: Monetary markets usually appear to flip between completely different “moods” or “regimes”, assume high-volatility vs. low-volatility durations, or bull vs. bear markets. Dynamic Bayesian Networks (DBNs) can mannequin these hidden market states and the chances of transitioning between them, permitting methods to adapt their conduct accordingly (Murphy, 2002).

The Upsides and Downsides: What to Hold in Thoughts

Like all highly effective software, Bayesian strategies include their very own set of execs and cons.

Benefits:

- Intuitive framework for updating beliefs.

- Quantifies uncertainty straight.

- Works nicely with restricted knowledge by utilizing priors.

- Permits incorporation of knowledgeable information.

- Gives a coherent strategy to evaluate and mix fashions.

Limitations:

- Selection of Prior: The choice of a previous might be subjective and may considerably affect the posterior, particularly with small datasets. A poorly chosen prior can result in poor outcomes. Whereas strategies for “goal” or “uninformative” priors exist, their appropriateness is commonly debated.

- Computational Value: For complicated fashions, estimating the posterior distribution (particularly utilizing MCMC strategies) might be computationally intensive and time-consuming, which is perhaps a constraint for high-frequency buying and selling purposes.

- Mathematical Complexity: Whereas PPLs are useful, a stable understanding of likelihood idea and Bayesian ideas remains to be wanted to use these strategies accurately and interpret outcomes.

Continuously Requested Questions

Q. What makes Bayesian statistics completely different from conventional (frequentist) strategies in buying and selling?

Bayesian statistics treats mannequin parameters as random variables with a and permits beliefs to be up to date with new knowledge. In distinction, frequentist strategies assume parameters are mounted and require giant knowledge samples. Bayesian pondering is extra dynamic and well-suited to the non-stationary, unsure nature of economic markets.

Q. How does Bayes’ Theorem assist in buying and selling choices? Are you able to give an instance?

Bayes’ Theorem is used to replace chances primarily based on new market data. For instance, if a inventory worth jumps 1% earlier than earnings, and previous knowledge suggests this usually precedes a constructive shock, Bayes’ Theorem helps revise your confidence in that speculation, turning a 30% perception into 60%, which may straight affect your commerce.

Q. What are priors and posteriors in Bayesian fashions, and why do they matter in finance?

A prior displays your preliminary perception (from previous knowledge, idea, or knowledgeable views), whereas a posterior is the up to date perception after contemplating new proof. Priors assist enhance efficiency in low-data or high-uncertainty conditions and permit integration of different knowledge or human instinct in monetary modelling.

Q. What varieties of buying and selling issues are finest suited to Bayesian strategies?

Bayesian strategies are perfect for:

- Parameter estimation that adapts (instance, volatility, beta, shifting common lengths)

- Market regime detection utilizing dynamic Bayesian networks

- Danger administration (instance, Bayesian VaR)

- Technique optimisation utilizing Bayesian Optimisation

- Classification duties with Naive Bayes fashions

These approaches assist construct extra responsive and strong methods.

Q. Can Bayesian strategies work with restricted or noisy market knowledge?

Sure! Bayesian strategies shine in low-data environments by incorporating informative priors. In addition they deal with uncertainty naturally, representing beliefs as distributions slightly than mounted values, essential when modelling uncommon market occasions or new property.

Q. How is Bayesian optimisation utilized in buying and selling technique design?

Bayesian optimisation is used to tune technique parameters (like entry/exit thresholds) effectively. As a substitute of brute-force grid search, it balances exploration and exploitation utilizing a probabilistic mannequin (instance, Gaussian Processes), making it good for expensive backtesting environments.

Q. Are easy fashions like Naive Bayes actually helpful in buying and selling?

Sure, Naive Bayes classifiers can function light-weight baseline fashions to foretell market course utilizing indicators like RSI, MACD, or sentiment scores. Whereas the belief of unbiased options is simplistic, these fashions can supply quick and surprisingly stable predictions, particularly with well-engineered options.

Q. How does Bayesian pondering improve threat administration?

Bayesian fashions, like Bayesian VaR (a, replace threat estimates dynamically as new knowledge (or shocks) arrive, not like static historic fashions. This makes them extra adaptive to unstable circumstances, particularly throughout uncommon or excessive occasions.

Q. What instruments or libraries are used to construct Bayesian buying and selling fashions?

Standard instruments embody:

- PyMC and PyMC3 (Python)

- Stan (through R or Python)

- TensorFlow Chance

These help strategies like MCMC and variational inference, enabling the event of every little thing from easy Bayesian regressions to Bayesian deep studying fashions.

Q. How can I get began with Bayesian strategies in buying and selling?

Begin with small tasks:

- Take a look at a Naive Bayes classifier on market course.

- Use Bayesian updating for a method’s win price estimation.

- Attempt parameter tuning with Bayesian optimisation.

- Then discover extra superior purposes and think about studying assets equivalent to Quantra’s programs on machine studying in buying and selling and EPAT for a complete algo buying and selling program with Bayesian strategies.

Conclusion: Embrace the Bayesian Mindset for Smarter Buying and selling!

So, there you will have it! Bayesian statistics affords an extremely highly effective and versatile strategy to navigate the unavoidable uncertainties that include monetary markets. By providing you with a proper strategy to mix your prior information with new proof because it streams in, it helps merchants and quants construct algorithmic methods which can be extra adaptive, strong, and insightful.

Whereas it is not a magic bullet, understanding and making use of Bayesian ideas may help you progress past inflexible assumptions and make extra nuanced, probability-weighted choices. Whether or not you are tweaking parameters, classifying market circumstances, keeping track of threat, or optimising your total technique, the Bayesian strategy encourages a mindset of steady studying, and that’s completely important for long-term success within the continuously shifting panorama of algorithmic buying and selling.

Begin small, maybe by experimenting with how priors influence a easy estimation, or by making an attempt out a Naive Bayes classifier. As you develop extra snug, the wealthy world of Bayesian modeling will open up new avenues for enhancing your buying and selling edge.

For those who’re severe about taking your quantitative buying and selling expertise to the following degree, think about Quantra’s specialised programs like “Machine Studying & Deep Studying for Buying and selling” to reinforce Bayesian strategies, or EPAT for complete, industry-leading algorithmic buying and selling certification. These equip you to sort out complicated markets with a major edge.

Continue learning, maintain experimenting!

Additional Studying

For a structured and utilized studying path with Quantra, begin with Python for Buying and selling: Fundamental, then transfer to Technical Indicators Methods in Python.

For machine studying, discover the Machine Studying & Deep Studying in Buying and selling: Novices studying observe, which supplies sensible hands-on insights into implementing fashions like Bayesian classifiers in monetary markets.

For those who’re a severe learner, you may take the Govt Programme in Algorithmic Buying and selling (EPAT), which covers statistical modelling, machine studying, and superior buying and selling methods with Python.

References

- Neyman, J. (1937). Define of a idea of statistical estimation primarily based on the classical idea of likelihood. Philosophical Transactions of the Royal Society of London. Collection A, Mathematical and Bodily Sciences, 236(767), 333-380.

https://royalsocietypublishing.org/doi/10.1098/rsta.1937.0005 - Gelman, A., Carlin, J. B., Stern, H. S., Dunson, D. B., Vehtari, A., & Rubin, D. B. (2013). Bayesian Information Evaluation (third ed.). CRC Press.

https://www.routledge.com/Bayesian-Information-Evaluation/Gelman-Carlin-Stern-Dunson-Vehtari-Rubin/p/e book/9781439840955 - Bernardo, J. M., & Smith, A. F. M. (2000). Bayesian Idea. John Wiley & Sons.

https://onlinelibrary.wiley.com/doi/e book/10.1002/9780470316870 - Ghosh, J. Ok., Delampady, M., & Samanta, T. (2006). An Introduction to Bayesian Evaluation: Idea and Strategies. Springer.

http://ndl.ethernet.edu.et/bitstream/123456789/58197/1/41percent20pdf.pdf - Hoeting, J. A., Madigan, D., Raftery, A. E., & Volinsky, C. T. (1999). Bayesian mannequin averaging: A tutorial. Statistical Science, 14(4), 382-417.

https://www.stat.colostate.edu/~jah/papers/statsci.pdf - Berger, J. O., & Berry, D. A. (1988). Statistical evaluation and the phantasm of objectivity. American Scientist, 76(2), 159-165.

https://www.medication.mcgill.ca/epidemiology/Joseph/programs/frequent/Berger.Berry.pdf - Welch, G., & Bishop, G. (2006). An introduction to the Kalman filter. TR 95-041, College of North Carolina at Chapel Hill, Division of Laptop Science.

https://www.cs.unc.edu/~welch/media/pdf/kalman_intro.pdf - Rish, I. (2001, August). An empirical research of the naive Bayes classifier. In IJCAI 2001 workshop on empirical strategies in synthetic intelligence (Vol. 3, No. 22, pp. 41-46).

https://www.researchgate.internet/publication/228845263_An_Empirical_Study_of_the_Naive_Bayes_Classifier - Snoek, J., Larochelle, H., & Adams, R. P. (2012). Sensible Bayesian optimization of machine studying algorithms. Advances in neural data processing methods, 25.

https://papers.nips.cc/paper_files/paper/2012/hash/05311655a15b75fab86956663e1819cd-Summary.html - Neal, R. M. (1995). Bayesian studying for neural networks. (Doctoral dissertation, College of Toronto).

https://glizen.com/radfordneal/ftp/thesis.pdf - Gal, Y., & Ghahramani, Z. (2016). Dropout as a Bayesian approximation: Representing mannequin uncertainty in deep studying. Within the Worldwide Convention on machine studying (pp. 1050-1059). PMLR.

https://proceedings.mlr.press/v48/gal16.html - Salvatier, J., Wiecki, T. V., & Fonnesbeck, C. (2016). Probabilistic programming in Python utilizing PyMC3. PeerJ Laptop Science, 2, e55.

https://peerj.com/articles/cs-55/ - Carpenter, B., Gelman, A., Hoffman, M. D., Lee, D., Goodrich, B., Betancourt, M., … & Riddell, A. (2017). Stan: A probabilistic programming language. Journal of Statistical Software program, 76(1), 1-32.

https://www.jstatsoft.org/article/view/v076i01 - Blei, D. M., Kucukelbir, A., & McAuliffe, J. D. (2017). Variational inference: A evaluation for statisticians. Journal of the American Statistical Affiliation, 112(518), 859-877.

https://www.tandfonline.com/doi/full/10.1080/01621459.2017.1285773 - Murphy, Ok. P. (2002). Dynamic Bayesian Networks: Illustration, Inference and Studying. (Doctoral dissertation, College of California, Berkeley).

https://www.cs.ubc.ca/~murphyk/Thesis/thesis.html

Disclaimer: This weblog put up is for informational and academic functions solely. It doesn’t represent monetary recommendation or a advice to commerce any particular property or make use of any particular technique. All buying and selling and funding actions contain important threat. At all times conduct your personal thorough analysis, consider your private threat tolerance, and think about looking for recommendation from a professional monetary skilled earlier than making any funding choices.